Meaning and Uses of fund flow statement- A Fund Flow Statement is a financial report that explains the changes in the financial position of a business between two balance sheet dates. It shows how funds have been sourced (inflow) and how they have been used (outflow) during a specific period, typically one financial year. The statement highlights movements in the working capital of a company, distinguishing between long-term sources and uses of funds and short-term changes in working capital.

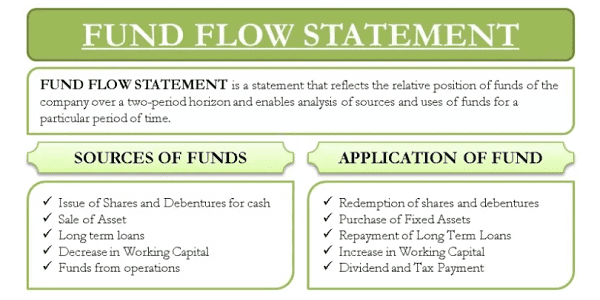

Key Components:

- Sources of Funds: Include activities that bring in funds, such as issuing shares, taking loans, or selling assets.

- Uses of Funds: Include how the funds were used, like purchasing fixed assets, repaying loans, or distributing dividends.

- Working Capital Changes: Reflects how the company’s current assets and liabilities have changed over the period.

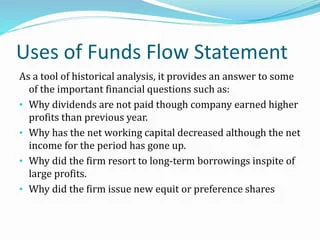

Uses of a Fund Flow Statement:

- Financial Analysis: It helps management and stakeholders understand how funds are raised and deployed, offering insights into the company’s financial health.

- Planning and Decision-Making: By analyzing past fund flows, businesses can make better decisions about future investments and financing needs.

- Assessing Liquidity: It identifies whether the company has sufficient funds for daily operations and debt obligations by showing changes in working capital.

- Creditworthiness Assessment: Lenders use fund flow statements to assess the company’s ability to repay loans by analyzing its cash generation and utilization.

- Investment Appraisal: Investors use it to determine how efficiently the company uses its resources and whether the business is growing sustainably.

- Identifying Financial Risks: The statement can indicate potential financial risks like over-dependence on borrowed funds or inefficient capital utilization.

In summary, a fund flow statement provides a comprehensive overview of a company’s financial activities, helping various stakeholders make informed decisions.

What is Required Meaning and Uses of fund flow statement

A Fund Flow Statement is a financial document that shows the sources and uses of funds within an organization over a specific period. It tracks the movement of funds (working capital) between two balance sheet dates, revealing how the company obtained and utilized its financial resources. Unlike a cash flow statement, which focuses solely on cash, a fund flow statement considers all components of working capital, such as inventories, receivables, and payables.

Key Points:

- It shows the inflow and outflow of funds, focusing on long-term financial activities and their impact on the company’s overall financial position.

- It distinguishes between short-term and long-term sources and uses of funds, giving a broader view of financial movements.

Uses of Fund Flow Statement:

- Analyzing Financial Position: It helps stakeholders analyze how effectively the company has managed its financial resources by tracking the flow of funds into and out of the business.

- Assessing Working Capital Management: By showing changes in current assets and liabilities, the statement reveals how well the company manages its working capital.

- Investment Decision-Making: Investors and management use this statement to understand how funds are being sourced and deployed, helping make informed decisions about future investments and resource allocation.

- Determining Long-term Financial Health: It provides insights into the long-term viability of a business by identifying how it finances major investments and repays long-term obligations.

- Evaluating Fund Utilization: The statement shows how efficiently funds are being used, such as for purchasing assets, paying debts, or distributing dividends.

- Planning and Forecasting: It aids in financial planning by showing trends in fund movements, enabling the business to anticipate future funding needs and avoid liquidity crises.

- Identifying Financial Issues: The statement can uncover financial challenges, such as excessive borrowing, over-reliance on external financing, or poor asset management.

In summary, a fund flow statement is a crucial tool for analyzing a company’s financial activities, helping both management and external stakeholders assess the efficiency of fund utilization and make strategic decisions for the future.

Who is Required Meaning and Uses of fund flow statement

A Fund Flow Statement is typically prepared and used by organizations for internal and external financial analysis, particularly by stakeholders who need to understand the financial health and resource management of a company. The entities that are commonly required to prepare or use a fund flow statement include:

- Large Corporations: Companies with complex operations and multiple sources of funding use fund flow statements to manage their finances efficiently. This is especially important for organizations dealing with large investments and long-term liabilities.

- Financial Institutions: Banks and financial institutions may request fund flow statements from borrowers (businesses) to assess their ability to manage funds and repay loans.

- Investors and Shareholders: Investors use fund flow statements to analyze how effectively a company is managing its funds, which helps them decide whether to invest more or divest from the business.

- Management and Internal Auditors: Company management uses this statement to monitor the flow of funds and make decisions about future investments, working capital management, and long-term financial strategy. Internal auditors may use it to ensure proper allocation of funds.

- Creditors: Lenders and suppliers rely on fund flow statements to assess the financial stability of a company and evaluate whether it can meet its debt obligations.

- Regulatory Bodies: In some cases, regulatory bodies may require companies to submit fund flow statements as part of compliance reporting, especially in industries that have to follow strict financial disclosure rules.

Uses of a Fund Flow Statement:

- Financial Performance Analysis: It helps assess a company’s ability to generate funds from various sources and the efficiency with which those funds are being used.

- Creditworthiness Evaluation: Creditors and lenders use it to determine whether the company is financially sound and capable of repaying loans.

- Investment Decisions: Investors use the statement to understand how the company is financing its growth and to determine whether funds are being used productively.

- Working Capital Management: Management can analyze changes in current assets and liabilities to manage working capital better.

- Financial Planning and Forecasting: Helps businesses project future cash needs and prepare for significant expenses, investments, or financial downturns.

- Identifying Financial Risks: It can highlight issues like liquidity problems, excessive borrowing, or inefficient fund utilization, prompting corrective action.

In summary, fund flow statements are essential for various stakeholders—management, investors, lenders, and regulators—to assess the financial stability and resource allocation within an organization.

When is Required Meaning and Uses of fund flow statement

A Fund Flow Statement is typically required or prepared in the following situations:

- During Financial Reporting: Companies may prepare a fund flow statement at the end of a financial period (usually annually) as part of their financial reporting process. This helps to explain changes in the company’s financial position between two balance sheet dates.

- For Loan Applications: When a company applies for a loan or credit from a bank or financial institution, the lender may require a fund flow statement to assess the company’s financial stability and its ability to manage funds.

- During Mergers, Acquisitions, or Restructuring: When companies are involved in mergers, acquisitions, or internal restructuring, fund flow statements are essential to evaluate how funds are flowing within the organization and how financial changes will impact the business.

- For Investor Review: Investors often request fund flow statements to understand how the company has sourced and utilized its funds over time. This is critical for assessing the long-term viability and financial health of the company before making investment decisions.

- For Internal Management Review: Management may use a fund flow statement at any point during the fiscal year to review the efficiency of fund utilization, plan for future expenses, or manage working capital. This can be a routine part of financial analysis.

- During Audits: External or internal audits might require the preparation of a fund flow statement to track fund movements and ensure that resources are being utilized properly.

- During Financial Crisis or Cash Flow Issues: If a company is facing liquidity issues or financial stress, a fund flow statement may be prepared to analyze the sources and uses of funds and to identify problem areas where cash flow can be improved.

Uses of a Fund Flow Statement:

- Financial Performance Tracking: It shows how funds are moving within the company, helping management and stakeholders understand financial performance over time.

- Investment and Financing Decisions: Helps in making decisions related to sourcing funds and investing in projects by analyzing how funds have been utilized in the past.

- Working Capital Management: It helps businesses monitor and optimize the use of working capital by identifying where funds are tied up and how they can be freed up for better utilization.

- Forecasting and Planning: Businesses use fund flow statements to plan for future financial needs and to forecast how funds will be sourced and applied.

- Identifying Financial Issues: The statement can reveal potential financial issues such as over-borrowing, poor fund allocation, or cash flow problems, prompting corrective action.

- Assessing Long-term Financial Health: The statement provides a clear picture of how long-term assets and liabilities are managed, giving insight into the company’s financial stability over time.

In summary, a fund flow statement is required at critical points in a company’s financial cycle, such as during annual reporting, loan applications, investment reviews, or when managing cash flow issues. Its uses are vast, ranging from performance analysis to long-term financial planning.

Where is Required Meaning and Uses of fund flow statement

A Fund Flow Statement is typically required in several contexts and regions where financial reporting and analysis are critical. Here are the common places and situations where it is necessary:

- Within Corporations:

- Internal Financial Management: Companies of various sizes, particularly large corporations and publicly traded companies, use fund flow statements internally to manage finances, track fund usage, and make strategic financial decisions.

- Board Meetings: Fund flow statements are often presented during board meetings to give directors and stakeholders an overview of the financial status and movement of funds within the company.

- Financial Institutions and Banks:

- Loan Applications and Credit Approvals: Banks and other financial institutions may request a fund flow statement from businesses applying for loans to evaluate their ability to manage and repay funds.

- Monitoring of Borrowers: Lenders use this statement to monitor how companies that have received loans are utilizing their funds and managing debt.

- For Investors and Shareholders:

- Investment Decisions: Investors, venture capitalists, and shareholders often require fund flow statements to assess the company’s financial health before making investment decisions. It gives them insight into how efficiently the company is using its resources.

- Stock Markets and Publicly Traded Companies: Publicly listed companies may prepare fund flow statements to be included in their annual reports to provide transparency to their shareholders.

- Auditing Firms:

- Financial Audits: External auditors may require a fund flow statement to evaluate the financial stability and performance of a company as part of the audit process. This is particularly important in statutory audits or during the due diligence process.

- Internal Audits: Large companies may also prepare fund flow statements as part of their internal audit processes to ensure the efficient allocation of funds.

- Mergers, Acquisitions, and Corporate Restructuring:

- During Mergers or Acquisitions: When companies are merging or acquiring another business, a fund flow statement may be required to evaluate the financial impact and how funds will flow between entities.

- Corporate Restructuring: During corporate restructuring or spin-offs, a fund flow statement is essential to show how funds are being reallocated or used for restructuring activities.

- Government and Regulatory Authorities:

- Compliance and Regulatory Reporting: Some countries and jurisdictions may require companies to submit fund flow statements as part of their regulatory filings to ensure transparency in financial reporting, especially for large corporations and publicly listed companies.

- Tax Assessments: In some cases, tax authorities may request a fund flow statement to analyze how funds are being used and ensure that tax obligations are met accurately.

- Non-Profit Organizations:

- Grant and Fund Management: Non-profit organizations that rely on grants or donations may be required to prepare fund flow statements to show how they manage and utilize funds for their activities. Donors and grant providers may require this statement to ensure proper fund usage.

Uses of a Fund Flow Statement:

- Financial Analysis: It helps in analyzing the financial performance and efficiency of a company by tracking how funds are sourced and utilized.

- Investment Decisions: Investors and lenders use it to assess whether a company is using funds productively, which influences investment and lending decisions.

- Managing Working Capital: Helps management assess changes in working capital and optimize the use of short-term funds for day-to-day operations.

- Financial Planning and Forecasting: It aids businesses in projecting future cash flows, planning for capital expenditures, and ensuring that funds are available for critical operations.

- Risk Management: The statement highlights potential financial issues, such as liquidity problems or over-reliance on borrowed funds, prompting corrective measures.

- Creditworthiness Evaluation: Lenders and creditors evaluate fund flow statements to assess a company’s financial health and ability to meet its obligations.

In summary, fund flow statements are required across various sectors, including corporations, financial institutions, auditing firms, investors, regulatory authorities, and non-profits, primarily for financial analysis, reporting, and decision-making purposes.

How is Required Meaning and Uses of fund flow statement

The Fund Flow Statement is prepared in a systematic process to analyze the movement of funds within an organization over a specific period. Here is a step-by-step explanation of how the statement is prepared and its typical uses:

Preparation of Fund Flow Statement:

- Start with Two Consecutive Balance Sheets:

- A fund flow statement compares two balance sheets (at the start and end of a financial period) to identify changes in the financial position.

- The comparison helps detect movements in the company’s assets, liabilities, and shareholders’ equity.

- Identify Changes in Working Capital:

- Calculate changes in current assets (such as inventories, receivables, and cash) and current liabilities (such as payables and short-term loans) to determine if there’s an increase or decrease in working capital.

- Increase in Working Capital is considered a use of funds, while decrease in Working Capital is considered a source of funds.

- Determine Sources of Funds: Sources of funds include:

- Issuance of Shares or Debentures: If a company issues new equity or debt, it receives funds.

- Sale of Fixed Assets: Selling machinery, equipment, or other long-term assets brings in funds.

- Borrowings: Taking loans or other long-term financing contributes to the inflow of funds.

- Determine Uses of Funds: Uses of funds include:

- Purchase of Fixed Assets: Buying new machinery, buildings, or land uses funds.

- Repayment of Loans: Repaying long-term loans or reducing debt consumes funds.

- Dividend Payments: Paying dividends to shareholders is a use of funds.

- Prepare the Statement:

- List the sources and uses of funds and summarize them to determine the net increase or decrease in working capital.

- The format typically has two main sections:

- Sources of Funds: Lists all inflows.

- Uses of Funds: Lists all outflows.

- The difference between sources and uses reflects changes in working capital.

- Analyze Changes in Financial Position:

- The final part of the fund flow statement analyzes how the sources and uses of funds impacted the company’s financial position, particularly its working capital.

Uses of Fund Flow Statement:

- Understanding Financial Health: It helps companies and stakeholders understand how financial resources are being sourced and deployed over time. This is crucial for assessing the overall financial stability of the business.

- Financial Planning and Forecasting: Businesses use fund flow statements to plan future resource allocation, ensuring they have enough funds to meet upcoming obligations or investments.

- Working Capital Management: The statement provides insights into how effectively the company manages its working capital. It helps businesses ensure that they have sufficient liquid assets to meet short-term obligations.

- Investment and Lending Decisions: Investors and lenders use the fund flow statement to evaluate whether a company is managing its funds prudently. This helps them decide whether to invest in or lend to the business.

- Evaluating Liquidity and Solvency: By showing how funds are being used and generated, the fund flow statement provides insight into the company’s ability to meet short-term and long-term obligations, thus indicating liquidity and solvency.

- Audit and Compliance: It serves as a key document for both internal and external audits, ensuring that funds have been properly used and reported, and aiding in regulatory compliance.

How is a Fund Flow Statement Used?

- Management:

- Decision-Making: Helps management make informed decisions regarding expansion, resource allocation, and financing by showing how funds are available and used.

- Corrective Actions: If funds are not being used efficiently (e.g., excess working capital tied up in inventory), management can take corrective actions.

- Investors:

- Investors analyze fund flow statements to assess whether their investment is generating returns and whether the company is managing resources well.

- Creditors and Banks:

- Before extending loans, creditors review fund flow statements to ensure that the company is capable of managing its financial obligations and making timely repayments.

- Regulators and Auditors:

- Regulatory authorities may review the statement to ensure compliance with financial reporting standards. Auditors use it to check the accuracy of financial transactions and fund movements.

In conclusion, a fund flow statement is required and prepared in various financial contexts to analyze fund movements, improve financial management, and assist in planning, decision-making, and reporting. It serves as a valuable tool for management, investors, creditors, and auditors.

Case Study on Meaning and Uses of fund flow statement

Company Overview:

ABC Manufacturing Ltd. is a mid-sized manufacturing company specializing in automobile parts. Over the last financial year, the company underwent expansion by investing in new machinery and increasing its production capacity. The company wants to analyze how it managed its funds during the expansion phase and its impact on working capital. To do so, it prepares a Fund Flow Statement.

Situation Before Fund Flow Analysis:

At the beginning of the year, ABC Manufacturing had the following financial situation:

- Current Assets: $1,000,000

- Current Liabilities: $500,000

- Working Capital: $500,000 (Current Assets – Current Liabilities)

During the year, the company made several financial moves, including:

- Investing in new machinery worth $400,000

- Issuing new shares worth $300,000

- Repaying long-term loans amounting to $200,000

- Selling old equipment for $100,000

The management wants to see the impact of these activities on the company’s financial position and working capital. To do this, they prepare a Fund Flow Statement.

Meaning of Fund Flow Statement:

A Fund Flow Statement will help ABC Manufacturing understand the sources of funds (how money was generated) and the uses of funds (how money was spent) over the financial year. This statement allows management to analyze whether the company effectively managed its resources, particularly during the expansion phase.

Preparation of the Fund Flow Statement for ABC Manufacturing Ltd.

Sources of Funds:

- Issuance of Shares: $300,000 (raised by issuing new equity)

- Sale of Old Equipment: $100,000 (funds generated from selling old machinery)

Total Sources of Funds = $400,000

Uses of Funds:

- Purchase of New Machinery: $400,000 (invested in new production equipment)

- Loan Repayment: $200,000 (repaid long-term debt)

Total Uses of Funds = $600,000

Change in Working Capital:

- At the beginning of the year, the working capital was $500,000.

- At the end of the year, the company’s Current Assets were $1,200,000, and Current Liabilities were $700,000.

- New Working Capital = $1,200,000 – $700,000 = $500,000 (no change in working capital)

Analysis and Interpretation:

1. Sources and Uses of Funds:

- ABC Manufacturing Ltd. sourced $400,000 from the issuance of new shares and selling old equipment.

- The company used $600,000, mainly for purchasing new machinery ($400,000) and repaying loans ($200,000).

2. Impact on Working Capital:

- Despite significant investments and debt repayments, the company’s working capital remained unchanged at $500,000. This means the company managed to balance its sources and uses of funds without negatively impacting short-term liquidity.

3. Financial Health Analysis:

- Expansion Financing: The company’s decision to issue new shares raised sufficient funds to partially finance the purchase of new machinery, a positive sign for future growth.

- Debt Management: Repaying $200,000 of long-term loans shows a responsible approach to debt reduction, though it did increase the outflow of funds.

- Efficiency: The sale of old equipment helped generate funds, showing that ABC Manufacturing is efficiently managing its assets.

Uses of the Fund Flow Statement:

1. Management Decision-Making:

- The fund flow statement shows that ABC Manufacturing was able to expand its production capacity without straining its working capital. The management can use this information to plan future investments and assess the company’s liquidity.

2. Working Capital Management:

- By analyzing the change in current assets and liabilities, the company can ensure that it has enough liquidity to meet short-term obligations, even after making significant investments.

3. Investor Confidence:

- The statement will be useful for potential investors to understand how efficiently the company is managing its funds. The fact that the company expanded operations without depleting its working capital signals strong financial management.

4. Loan Assessment:

- Banks or financial institutions evaluating ABC Manufacturing for future loans would see that the company is reducing its debt and financing its growth through equity and asset sales, making it a reliable candidate for further credit.

5. Planning Future Strategies:

- The fund flow statement allows the company to plan future cash needs, whether to raise more capital, further reduce debt, or invest in additional machinery. The company can use this to strategize for long-term growth.

Conclusion:

This case study of ABC Manufacturing Ltd. illustrates the importance and uses of a Fund Flow Statement. By preparing the statement, the company was able to evaluate its sources and uses of funds over the financial year, ensuring efficient fund management without compromising its working capital. The statement provided valuable insights for management, investors, and creditors, serving as a key tool for financial decision-making, liquidity management, and planning future growth strategies.

White paper on Meaning and Uses of fund flow statement

Executive Summary

A Fund Flow Statement is a critical financial tool that provides a detailed analysis of the inflows and outflows of funds within an organization over a specific period. Unlike other financial statements, it focuses on the movement of working capital, helping stakeholders understand how financial resources are sourced and utilized. This white paper explores the meaning, importance, and practical uses of fund flow statements in corporate finance, including its role in financial analysis, decision-making, investment evaluations, and liquidity management.

Introduction

Financial reporting plays a crucial role in business management, enabling organizations to make informed decisions based on their financial health. While balance sheets and income statements provide a snapshot of financial position and performance, they do not track the movement of funds in a company. The Fund Flow Statement fills this gap by showing how funds are obtained and deployed within the business, offering insights into working capital management and long-term financial planning.

1. What is a Fund Flow Statement?

A Fund Flow Statement is a financial report that highlights the sources and uses of funds in an organization over a specific accounting period. The term “funds” in this context refers to working capital, which is the difference between current assets and current liabilities.

The statement breaks down all the sources of funds, such as borrowing, equity issuance, or asset sales, and compares them to the uses of funds, such as investments, loan repayments, and dividend payments. By doing so, it helps determine whether the company has efficiently managed its resources, either increasing or decreasing its working capital.

Key Components of a Fund Flow Statement:

- Sources of Funds: Inflows into the business, which can include:

- Issuance of equity or debt

- Sale of fixed assets or investments

- Cash inflows from operations, if significant

- Uses of Funds: Outflows from the business, which can include:

- Purchase of long-term assets (fixed assets)

- Repayment of loans and liabilities

- Dividend distributions

- Increase in working capital (current assets)

Key Difference from Cash Flow Statement:

A fund flow statement differs from a cash flow statement, which focuses only on cash inflows and outflows. A fund flow statement tracks the movement of all financial resources, including non-cash components such as receivables, inventories, and payables, and is more comprehensive for long-term planning.

2. Importance of a Fund Flow Statement

A fund flow statement serves as a vital tool for various stakeholders by providing clarity on how financial resources are managed. It is particularly useful for analyzing long-term financial strategies, managing working capital, and assessing a company’s ability to finance growth and repay debt.

Significance for Different Stakeholders:

- Management: Helps in planning financial strategies, optimizing resource allocation, and managing working capital effectively.

- Investors: Offers insight into how funds are utilized, which aids in evaluating the company’s financial health and long-term growth potential.

- Creditors and Lenders: Provides a detailed view of the company’s fund management and debt repayment capability, essential for making lending decisions.

- Auditors: Assists in identifying discrepancies in fund management, ensuring that financial practices are in compliance with regulatory requirements.

3. Practical Uses of a Fund Flow Statement

The fund flow statement has several practical applications in corporate finance and can be used for a variety of purposes:

1. Financial Analysis

A fund flow statement provides insight into how a company’s financial resources are managed over time. It helps assess whether the business is generating sufficient funds to finance its operations and investments or if it is over-reliant on external sources of funding, such as loans or equity.

For instance, if a company consistently uses its funds for asset acquisition and debt repayment without generating sufficient internal resources, it may face liquidity challenges in the future. This analysis helps identify inefficiencies in fund management.

2. Working Capital Management

Efficient working capital management is crucial for maintaining a company’s liquidity. A fund flow statement highlights changes in working capital components, such as receivables, inventories, and payables, providing management with critical information on whether they are optimizing their short-term resources.

A company with excess inventories or high receivables may have working capital tied up in non-cash assets, potentially affecting its ability to meet short-term obligations. By analyzing these trends, management can take corrective actions to improve liquidity.

3. Investment Decision-Making

Investors rely on fund flow statements to assess how well a company is utilizing its funds for growth and long-term sustainability. If a company is consistently generating funds through operations and deploying them for productive investments, such as acquiring new assets or expanding operations, it signals strong financial health and growth prospects.

Conversely, if the company is heavily dependent on external financing or constantly repaying debt without sufficient internal fund generation, it may raise concerns about future profitability and solvency.

4. Loan and Credit Evaluation

Creditors and financial institutions use fund flow statements to evaluate a company’s ability to manage its financial obligations. A company that consistently generates sufficient funds for loan repayments and reinvestment is likely to be considered creditworthy. Additionally, fund flow statements help creditors understand whether the business relies on stable, internal sources of funding or if it is highly leveraged, which could indicate financial risk.

5. Long-Term Financial Planning

For long-term financial planning, a fund flow statement serves as a guide for understanding the company’s resource utilization and growth potential. By identifying how funds are being sourced and used, businesses can anticipate future capital needs and plan for upcoming expenses, debt repayments, or investments.

6. Identifying Financial Issues

A fund flow statement helps identify financial inefficiencies or problems early on. For example, if a company is continually using funds for debt repayment but not generating enough internally, it may indicate cash flow problems or over-leveraging. Similarly, high capital expenditures without corresponding revenue growth may signal over-investment in non-productive assets.

4. Example: Fund Flow Statement in Action

Consider XYZ Corp., a mid-sized technology company, which underwent an expansion during the year. XYZ Corp. raised $1 million by issuing new shares and borrowed $500,000 from a bank. The company used $800,000 to purchase new equipment, repaid $300,000 of its existing loans, and paid $100,000 in dividends to its shareholders.

Fund Flow Statement for XYZ Corp.:

Sources of Funds:

- Issuance of shares: $1,000,000

- Bank loan: $500,000

Total Sources of Funds = $1,500,000

Uses of Funds:

- Purchase of equipment: $800,000

- Loan repayment: $300,000

- Dividends: $100,000

Total Uses of Funds = $1,200,000

Net Increase in Working Capital = $1,500,000 (sources) – $1,200,000 (uses) = $300,000

This fund flow statement shows that XYZ Corp. has a net increase of $300,000 in working capital after its expansion, indicating effective fund management and liquidity preservation.

Conclusion

A Fund Flow Statement is a vital tool for businesses to track the movement of financial resources over time. It offers a comprehensive view of how funds are generated and used, providing critical insights into a company’s financial health, working capital management, and long-term growth potential. By helping stakeholders analyze fund utilization, the fund flow statement plays an essential role in decision-making, financial planning, and evaluating investment opportunities. Companies that efficiently manage their funds through informed analysis of fund flow statements are better positioned for sustained growth and financial stability.

Key Takeaways

- Meaning: A fund flow statement shows the movement of funds in and out of a business, focusing on changes in working capital.

- Importance: It provides valuable insights into financial health, liquidity, and long-term sustainability.

- Uses: It aids in financial analysis, investment decisions, credit evaluation, and working capital management.

- Practical Example: The statement offers a real-world analysis of how financial resources are allocated and managed.

Industrial Application of Meaning and Uses of fund flow statement

The Fund Flow Statement is a critical tool used across various industries to assess the financial health, liquidity, and long-term sustainability of businesses. Its ability to track the movement of funds, analyze working capital changes, and evaluate the sources and uses of financial resources makes it valuable in numerous industrial contexts.

This document explores the practical industrial applications of the fund flow statement, emphasizing its use in sectors such as manufacturing, construction, retail, technology, and more. Each industry relies on effective fund management to ensure operational efficiency, maintain liquidity, and fuel growth.

1. Manufacturing Industry

In manufacturing, effective financial management is crucial for maintaining production continuity, investing in capital-intensive equipment, and optimizing working capital. The fund flow statement is used to analyze the following:

Key Applications:

- Capital Investment Analysis: Manufacturing companies often invest heavily in equipment, machinery, and production facilities. A fund flow statement helps track these capital expenditures, ensuring that funds are being sourced appropriately and utilized for long-term growth.

- Working Capital Management: Manufacturers need to manage large inventories and receivables effectively. By tracking the changes in current assets and liabilities, the fund flow statement helps in managing working capital efficiently, ensuring that liquidity is maintained for day-to-day operations.

- Debt Repayment and Financing: Manufacturing firms may rely on debt to finance capital investments. The fund flow statement helps assess the company’s ability to repay loans and manage long-term financing while maintaining enough working capital for operations.

Example: A large automobile parts manufacturer invests in automated production lines, financed through a mix of equity and debt. The fund flow statement helps track how much working capital is available after the purchase and whether the funds were sourced effectively without harming operational liquidity.

2. Construction Industry

The construction industry is capital-intensive and project-based, making fund management complex and crucial. The fund flow statement is applied to manage the flow of financial resources for large-scale projects.

Key Applications:

- Project Financing: Construction projects often involve significant capital expenditures for materials, labor, and equipment. Fund flow statements are used to monitor the inflow of funds from loans, investor financing, or advances from clients and the outflow for project costs.

- Risk Management: The fund flow statement helps assess the availability of funds to cover ongoing project costs, ensuring that liquidity crises are avoided during the construction process.

- Cash Flow Monitoring: Construction firms often have uneven cash flow due to the nature of the project payments. The fund flow statement helps align sources of funds with project needs, ensuring that the firm can meet short-term obligations while maintaining profitability.

Example: A construction company working on a multi-million-dollar commercial real estate project uses a fund flow statement to track inflows from client payments and outflows for material purchases and labor costs, ensuring the project is adequately financed at each stage.

3. Retail Industry

Retail businesses handle high volumes of inventory, cash, and receivables, making liquidity and working capital management essential. A fund flow statement is a valuable tool in analyzing how retail companies manage cash flow and working capital.

Key Applications:

- Inventory Management: Retail companies often tie up significant amounts of working capital in inventory. The fund flow statement helps monitor whether changes in inventory are efficiently managed or if too much working capital is locked in stock.

- Financing Growth: Retailers frequently expand by opening new stores or investing in online platforms. A fund flow statement helps assess how these growth initiatives are funded (e.g., through equity, loans, or internal funds) and whether there is enough liquidity to support ongoing operations.

- Supplier Payments and Receivables: The statement helps monitor the timing of payments to suppliers and collection of receivables, ensuring that working capital cycles are efficiently managed.

Example: A large retail chain expands by opening new stores and increasing inventory to meet demand. The fund flow statement tracks whether internal cash generation is sufficient to fund expansion or if additional financing is required.

4. Technology and Startups

Technology companies, especially startups, often experience rapid growth, requiring effective fund management to fuel expansion and innovation. The fund flow statement plays a critical role in managing cash burn rates, capital investments, and funding rounds.

Key Applications:

- Venture Capital and Fundraising: Startups frequently rely on external funding through venture capital or equity investments. A fund flow statement helps track how much capital is raised and how efficiently these funds are being used for growth initiatives such as R&D, marketing, or infrastructure expansion.

- Cash Burn Rate: Tech companies, particularly startups, often operate at a loss in their early stages, making cash management crucial. The fund flow statement helps monitor cash burn rates and ensures that there is enough working capital to maintain operations while the company scales.

- Investment in Innovation: Technology companies often invest in intellectual property, software development, and talent acquisition. The fund flow statement tracks whether these investments are sustainable and how they impact working capital.

Example: A tech startup raises $5 million in a funding round to expand its cloud-based service platform. The fund flow statement helps the company assess how funds are being allocated to R&D, talent acquisition, and marketing, ensuring sufficient working capital for day-to-day operations.

5. Energy and Utilities Industry

Energy and utility companies, particularly those in sectors such as oil, gas, and power, deal with large capital expenditures for infrastructure development and maintenance. The fund flow statement is crucial for managing these significant financial flows.

Key Applications:

- Capital-Intensive Projects: Energy companies invest heavily in equipment, facilities, and research. The fund flow statement helps monitor the sources of capital (debt, equity, or internal funds) and ensures that funds are used efficiently for these long-term investments.

- Debt Management: Given the reliance on debt financing for large projects, the fund flow statement helps energy companies assess their ability to repay loans while maintaining working capital for operations.

- Regulatory Compliance and Dividends: Many utility companies are required to maintain specific financial ratios to comply with regulatory requirements. The fund flow statement helps track whether funds are being managed in compliance with such requirements and whether dividend payments can be sustained.

Example: A power generation company invests in renewable energy projects, such as wind farms, financed through a combination of debt and equity. The fund flow statement tracks the inflows and outflows, helping the company maintain sufficient working capital while repaying loans.

6. Pharmaceutical Industry

Pharmaceutical companies spend heavily on research and development (R&D) and face long lead times for product development. The fund flow statement is used to manage funds for R&D, clinical trials, and regulatory approvals.

Key Applications:

- R&D Financing: Pharmaceutical companies invest in new drugs and treatments. The fund flow statement tracks whether internal funds are sufficient for ongoing R&D or if external financing is necessary.

- Managing Working Capital: With long product development cycles, pharmaceutical companies must ensure they have enough working capital to fund ongoing operations, including clinical trials and production.

- Debt and Equity Financing: Many pharmaceutical firms rely on a mix of debt and equity to finance long-term projects. The fund flow statement helps assess the impact of these financing strategies on working capital and financial stability.

Example: A pharmaceutical company invests $100 million in a new drug development project. The fund flow statement helps the company track how much of this investment is financed through internal funds versus external debt, ensuring that sufficient working capital is available.

Conclusion

The Fund Flow Statement is a versatile tool used across various industries to analyze the movement of funds, assess working capital changes, and evaluate long-term financial strategies. Whether in capital-intensive industries such as manufacturing and construction, or fast-growing sectors like technology and pharmaceuticals, the fund flow statement provides valuable insights into financial resource management.

By analyzing sources and uses of funds, companies can make informed decisions about financing growth, managing debt, optimizing working capital, and maintaining liquidity. Its industrial applications demonstrate the statement’s significance as a cornerstone of financial analysis and strategic planning.

- Financial accounting

- Cost accounting

- Management accounting

- Forensic accounting

- Fund accounting

- Governmental accounting

- Social accounting

- Tax accounting

- Income statement

- Balance sheet

- Statement of changes in equity

- Debits and credits

- Revenue

- Cost of goods sold

- Operating expense

- Capital expenditure

- Depreciation

- Gross income

- Net income

- Audit

- Budget

- Cost

- Forensic

- Financial

- Fund

- Governmental

- Management

- Social

- Tax

- Financial

- Internal

- Firms

- Report

- Sarbanes–Oxley Act

- Accountants

- Accounting organizations

- Luca Pacioli

- Creative

- Earnings management

- Error account

- Hollywood

- Off-balance-sheet

- Two sets of books

- Convertible debt

- Exchangeable debt

- Mezzanine debt

- Pari passu

- Preferred equity

- Second lien debt

- Senior debt

- Senior secured debt

- Shareholder loan

- Stock

- Subordinated debt

- Warrant

- At-the-market offering

- Book building

- Bookrunner

- Bought deal

- Bought out deal

- Corporate spin-off

- Direct public offering

- Equity carve-out

- Follow-on offering

- Greenshoe Reverse

- Initial public offering

- Pre-IPO

- Private placement

- Public offering

- Rights issue

- Seasoned equity offering

- Secondary market offering

- Underwriting

- Buy side

- Contingent value rights

- Control premium

- Demerger

- Divestment

- Drag-along right

- Management due diligence

- Managerial entrenchment

- Mandatory offer

- Minority discount

- Pitch book

- Pre-emption right

- Proxy fight

- Post-merger integration

- Sell side

- Shareholder rights plan

- Special-purpose entity

- Special situation

- Squeeze-out

- Staggered board of directors

- Stock swap

- Super-majority amendment

- Synergy

- Tag-along right

- Takeover Reverse

- Tender offer

- Accretion/dilution analysis

- Adjusted present value

- Associate company

- Business valuation

- Conglomerate discount

- Cost of capital Weighted average

- Discounted cash flow

- Economic value added

- Enterprise value

- Fairness opinion

- Financial modeling

- Free cash flow Free cash flow to equity

- Market value added

- Minority interest

- Mismarking

- Modigliani–Miller theorem

- Net present value

- Pure play

- Real options

- Residual income

- Stock valuation

- Sum-of-the-parts analysis

- Tax shield

- Terminal value

- Valuation using multiples