Allocation and Apportionment of expenses- Allocation and apportionment of expenses are accounting methods used to distribute costs to different departments, projects, or products within an organization. Here’s a breakdown of each concept:

Allocation of Expenses

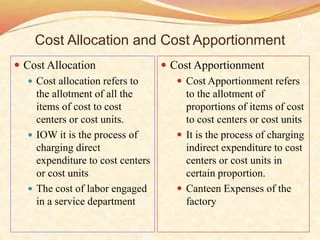

- Definition: Allocation refers to the process of assigning direct costs to specific departments, products, or projects. These costs can be directly traced to a particular cost object.

- Example: If a company incurs a direct expense for raw materials used in a specific product, that expense can be allocated entirely to that product.

Apportionment of Expenses

- Definition: Apportionment involves distributing indirect costs that cannot be directly traced to a specific cost object. These costs are spread across multiple departments or projects based on a reasonable basis.

- Example: If a company incurs a rent expense for its office space, this cost might be apportioned based on the square footage used by each department.

Key Differences

- Direct vs. Indirect Costs: Allocation deals with direct costs, while apportionment deals with indirect costs.

- Basis of Distribution: Allocation assigns costs specifically to a cost object, whereas apportionment distributes costs using a rational basis (e.g., usage, area, or time).

Importance

- Cost Control: Helps organizations monitor and control costs effectively.

- Financial Reporting: Provides a clearer picture of the financial performance of different departments or projects.

- Decision Making: Aids in budgeting and financial planning by providing insights into where resources are being consumed.

Methods of Allocation and Apportionment

- Direct Allocation: Assigns expenses directly to departments or products.

- Step-Down Method: Allocates costs from service departments to production departments in a sequential manner.

- Activity-Based Costing (ABC): Allocates overhead costs based on activities that drive costs, providing a more accurate picture of expenses.

Example of Allocation and Apportionment

Consider a manufacturing company with two departments: Production and Sales.

- Direct Allocation: The cost of materials used in production is directly allocated to the Production department.

- Apportionment: The utility cost for the entire facility (an indirect expense) may be apportioned based on the area occupied by each department. If the Production department occupies 70% of the space and Sales occupies 30%, then 70% of the utility cost would be charged to Production and 30% to Sales.

What is Required Allocation and Apportionment of expenses

Required allocation and apportionment of expenses refer to the necessary processes for distributing costs within an organization to ensure accurate financial reporting and effective cost management. This practice is essential for understanding how resources are consumed across different departments, products, or projects. Here’s a deeper look at the requirements involved:

1. Identification of Costs

- Direct Costs: Identify costs that can be directly attributed to a specific department or product, such as raw materials or labor.

- Indirect Costs: Identify costs that cannot be directly assigned and need to be apportioned, such as utilities, rent, and administrative expenses.

2. Establishing a Cost Allocation Policy

- Criteria: Define clear criteria for how costs will be allocated or apportioned (e.g., usage, square footage, headcount).

- Consistency: Ensure that the chosen method is applied consistently across reporting periods to maintain comparability.

3. Determining Allocation Bases

- Selection of Bases: Choose appropriate allocation bases for indirect costs (e.g., machine hours for manufacturing overhead, number of employees for administrative costs).

- Rationale: Ensure that the chosen bases have a logical correlation with the costs being apportioned.

4. Calculation of Allocations and Apportionments

- Formulas: Utilize formulas to calculate the allocated and apportioned amounts. For example:

- Allocation Formula: Allocated Cost=Total Direct Cost

- Apportionment Formula: Apportioned Cost=(Department Usage/Total Usage)×Total Indirect Cost

5. Recording and Reporting

- Financial Records: Ensure that all allocated and apportioned expenses are accurately recorded in the accounting system.

- Reporting: Provide detailed reports that outline how expenses have been allocated and apportioned for internal decision-making and external financial reporting.

6. Review and Adjustment

- Monitoring: Regularly review allocation and apportionment methods to ensure they remain relevant and accurate.

- Adjustment: Make adjustments as necessary based on changes in cost structure or organizational needs.

7. Regulatory Compliance

- Accounting Standards: Ensure that the allocation and apportionment of expenses comply with relevant accounting standards (e.g., GAAP, IFRS).

- Transparency: Maintain transparency in the methods used for allocation and apportionment to facilitate audits and external reviews.

Importance of Required Allocation and Apportionment

- Accurate Cost Measurement: Provides a true reflection of departmental or product costs, aiding in pricing and budgeting decisions.

- Performance Evaluation: Enables performance assessments of different departments or products based on their cost contributions.

- Strategic Decision-Making: Assists management in making informed decisions regarding resource allocation, cost control, and profitability analysis.

By adhering to these requirements, organizations can ensure that they effectively manage their expenses, leading to better financial performance and operational efficiency.

Who is Required Allocation and Apportionment of expenses

Required allocation and apportionment of expenses are primarily the responsibilities of several key stakeholders within an organization. Each plays a distinct role in ensuring that costs are allocated and apportioned appropriately. Here’s a breakdown of who is involved:

1. Finance and Accounting Department

- Role: This department is responsible for the overall management of the organization’s financial resources, including the allocation and apportionment of expenses.

- Responsibilities:

- Develop and implement policies for cost allocation.

- Maintain accurate records of direct and indirect costs.

- Prepare financial statements that reflect allocated and apportioned expenses.

2. Management

- Role: Management is involved in decision-making related to budgeting, pricing, and strategic planning.

- Responsibilities:

- Provide guidelines on how costs should be allocated or apportioned based on organizational goals.

- Review reports on allocated and apportioned expenses to make informed strategic decisions.

- Ensure that cost allocation practices align with the company’s objectives.

3. Cost Accountants

- Role: Cost accountants specialize in analyzing costs and their implications for the organization.

- Responsibilities:

- Analyze cost data to recommend allocation bases.

- Implement costing methods (e.g., Activity-Based Costing) to allocate and apportion costs accurately.

- Monitor the effectiveness of cost allocation and apportionment practices.

4. Department Heads and Managers

- Role: Leaders of individual departments are key in providing insights into the costs incurred by their teams.

- Responsibilities:

- Report on department-specific costs to the finance department.

- Ensure that allocated costs accurately reflect the resources used by their departments.

- Participate in discussions regarding cost allocation methods that impact their areas.

5. Internal Auditors

- Role: Internal auditors assess the efficiency and effectiveness of the organization’s financial processes.

- Responsibilities:

- Review allocation and apportionment practices to ensure compliance with accounting standards and internal policies.

- Recommend improvements in the processes for better accuracy and transparency.

- Ensure that all allocations and apportioned costs are justified and documented.

6. External Auditors

- Role: External auditors review the financial statements of an organization for compliance with applicable accounting standards.

- Responsibilities:

- Verify that the methods used for allocation and apportionment are consistent with accepted accounting practices.

- Evaluate whether the allocated and apportioned expenses are accurately reported in financial statements.

Importance of Collaboration

Effective allocation and apportionment of expenses require collaboration among these stakeholders to ensure that:

- Cost management aligns with the organization’s financial goals.

- Resources are allocated efficiently and effectively.

- Financial reports provide a true and fair view of the organization’s financial performance.

When is Required Allocation and Apportionment of expenses

The required allocation and apportionment of expenses typically occur at various stages throughout an organization’s financial cycle. Here’s an overview of when these processes are necessary:

1. Budgeting Period

- When: During the annual budgeting process or when preparing budgets for specific projects or departments.

- Purpose: Allocate expected costs to different departments or projects based on historical data and forecasts, helping in planning financial resources.

2. Monthly or Quarterly Reporting

- When: At the end of each month or quarter when financial reports are generated.

- Purpose: Ensure that expenses are accurately reflected in the financial statements for internal management review and external reporting.

3. Cost Analysis and Control

- When: Regularly throughout the year, especially during periods of financial review or when analyzing cost variances.

- Purpose: Monitor allocated and apportioned expenses to identify areas of overspending or inefficiency.

4. Project Implementation

- When: At the start and during the lifecycle of a project.

- Purpose: Allocate costs to projects based on resources consumed, ensuring accurate tracking of project expenses and budget adherence.

5. Financial Year-End Closing

- When: During the financial year-end closing process.

- Purpose: Finalize expense allocations and apportionments for the entire year to prepare for audits and financial statement preparation.

6. Internal and External Audits

- When: During audit periods, which can occur annually or semi-annually.

- Purpose: Review allocation and apportionment practices to ensure compliance with accounting standards and internal policies.

7. Changes in Operations

- When: Whenever there are significant changes in operations, such as:

- New product lines

- Changes in departmental structure

- Mergers or acquisitions

- Purpose: Reassess and potentially revise allocation and apportionment methods to reflect the new operational realities.

8. Regulatory Compliance Review

- When: When preparing for compliance reviews or changes in accounting standards.

- Purpose: Ensure that expense allocation and apportionment practices meet current regulatory requirements.

Summary

The allocation and apportionment of expenses are ongoing processes that align with various organizational activities. Regularly reviewing and adjusting these allocations ensures that the organization maintains accurate financial reporting and efficient resource management.

Where is Required Allocation and Apportionment of expenses

The required allocation and apportionment of expenses take place in several contexts within an organization. Here’s an overview of where these processes typically occur:

1. Within Financial Systems

- Accounting Software: Most organizations use accounting software (e.g., QuickBooks, SAP, Oracle) that includes modules for cost accounting, where allocations and apportionments can be automated and recorded.

- ERP Systems: Enterprise Resource Planning (ERP) systems often integrate financial management with other business processes, allowing for comprehensive tracking of expenses across departments.

2. Departmental Budgeting Offices

- Finance Department: The finance or accounting department is primarily responsible for managing the allocation and apportionment of expenses. This includes budgeting, forecasting, and reporting.

- Departmental Managers: Each department typically maintains its budget, where allocated expenses are tracked and reported to the finance team.

3. Management Meetings

- Budget Planning Sessions: During budgeting meetings, management discusses how expenses should be allocated to various projects and departments.

- Cost Review Meetings: Regular meetings to review financial performance often involve discussions about the allocation of indirect costs.

4. Project Management Offices (PMOs)

- Project Cost Tracking: In organizations with a PMO, allocated costs related to specific projects are monitored, and expenses are apportioned based on project resource usage.

5. Internal Audit Functions

- Audit Departments: Internal auditors examine the allocation and apportionment practices to ensure compliance with financial policies and procedures.

- External Audit Firms: During audits, external firms will review the allocation and apportionment of expenses as part of their examination of financial statements.

6. Financial Reporting Documents

- Financial Statements: Allocated and apportioned expenses are reflected in the organization’s financial statements (e.g., income statement, balance sheet).

- Management Reports: Regular financial reports prepared for management include detailed breakdowns of allocated and apportioned costs.

7. Training and Development Programs

- Training Sessions: Organizations may conduct training on cost allocation methods, which may include discussions on the necessary allocations and apportionments.

8. Regulatory Compliance Areas

- Compliance Departments: In regulated industries, compliance teams ensure that the allocation and apportionment of expenses adhere to legal and regulatory standards.

Summary

The processes of allocating and apportioning expenses occur across various departments and systems within an organization, primarily in finance, project management, and compliance contexts. Ensuring clear communication and coordination among these areas is crucial for effective expense management.

How is Required Allocation and Apportionment of expenses

The required allocation and apportionment of expenses are conducted through systematic processes that involve several steps. Here’s a detailed explanation of how these processes typically work:

1. Identify Costs

- Direct Costs: Identify costs that can be directly traced to specific departments, products, or projects (e.g., raw materials, direct labor).

- Indirect Costs: Identify costs that cannot be directly linked and need to be apportioned (e.g., utilities, rent, administrative salaries).

2. Establish Allocation and Apportionment Policies

- Define Policies: Develop clear policies regarding how costs will be allocated and apportioned.

- Set Criteria: Determine criteria for the allocation bases (e.g., square footage, number of employees, machine hours).

3. Select Allocation Bases

- Choosing Bases: Select appropriate bases for allocating indirect costs. Common bases include:

- Square Footage: For rent and utilities.

- Employee Headcount: For administrative expenses.

- Machine Hours: For manufacturing overhead.

- Rationale: Ensure that the chosen bases have a logical correlation with the costs being apportioned.

4. Calculate Allocations and Apportionments

- Direct Allocation: Direct costs are allocated entirely to the specific cost object.

- Example: If the cost of materials for Product A is $10,000, that amount is directly allocated to Product A.

- Indirect Apportionment: Use a formula to apportion indirect costs based on the chosen bases.

- Apportionment Formula: Apportioned Cost=(Department Usage/Total Usage)×Total Indirect Cost

- Example: If the total utility cost is $5,000 and the Production department uses 70% of the space, the apportioned utility cost for Production would be: Apportioned Utility Cost=(70/100)×5000=3500

5. Record and Document

- Accounting Entries: Record all allocated and apportioned expenses in the accounting system to ensure accurate financial reporting.

- Documentation: Maintain documentation that supports the allocation and apportionment decisions, including calculations and rationale.

6. Review and Adjust

- Regular Monitoring: Periodically review the allocation and apportionment methods to ensure they remain relevant and effective.

- Adjustments: Make necessary adjustments based on changes in cost structures, operations, or business needs.

7. Reporting

- Internal Reports: Prepare management reports that outline allocated and apportioned expenses for internal decision-making.

- Financial Statements: Ensure that allocated and apportioned expenses are accurately reflected in the organization’s financial statements for external reporting.

8. Compliance and Audit

- Internal Audits: Conduct regular audits to review allocation and apportionment practices for compliance with internal policies and accounting standards.

- External Audits: Prepare for external audits by ensuring that allocation and apportionment methods are well-documented and justified.

Summary

The process of allocation and apportionment of expenses involves identifying costs, establishing policies, selecting allocation bases, calculating amounts, recording transactions, and ensuring compliance through regular reviews and audits. By following these steps, organizations can manage costs effectively and maintain accurate financial reporting.

Case Study on Allocation and Apportionment of expenses

Here’s a detailed case study illustrating the allocation and apportionment of expenses in a manufacturing company called ABC Manufacturing Ltd.

Case Study: ABC Manufacturing Ltd.

Background

ABC Manufacturing Ltd. produces two main products: Product X and Product Y. The company operates from a single facility and incurs both direct and indirect costs. The management is interested in understanding how to accurately allocate and apportion expenses to determine the profitability of each product.

Step 1: Identify Costs

Direct Costs:

- Product X:

- Raw materials: $50,000

- Direct labor: $30,000

- Product Y:

- Raw materials: $40,000

- Direct labor: $25,000

Indirect Costs (Total: $30,000):

- Rent: $12,000

- Utilities: $6,000

- Administrative salaries: $12,000

Step 2: Establish Allocation and Apportionment Policies

ABC Manufacturing Ltd. decides to allocate direct costs directly to each product. For indirect costs, they will apportion them based on the following criteria:

- Rent and utilities will be apportioned based on square footage occupied by each product line.

- Administrative salaries will be apportioned based on the number of employees working on each product line.

Step 3: Select Allocation Bases

- Square Footage:

- Product X occupies 600 sq. ft.

- Product Y occupies 400 sq. ft.

- Total space = 1000 sq. ft.

- Number of Employees:

- Product X has 3 employees.

- Product Y has 2 employees.

- Total employees = 5.

Step 4: Calculate Allocations and Apportionments

- Direct Costs:

- Product X:

- Total Direct Costs = $50,000 (raw materials) + $30,000 (direct labor) = $80,000

- Product Y:

- Total Direct Costs = $40,000 (raw materials) + $25,000 (direct labor) = $65,000

- Product X:

- Apportion Indirect Costs:

- Rent:

- Product X: Rent for Product X=(600/1000)×12,000=7,200

- Product Y: Rent for Product Y=(400/1000)×12,000=4,800

- Utilities:

- Product X: Utilities for Product X=(600/1000)×6,000=3,600

- Product Y: Utilities for Product Y=(400/1000)×6,000=2,400

- Administrative Salaries:

- Product X: Admin Salaries for Product X=(3/5)×12,000=7,200

- Product Y: Admin Salaries for Product Y=(2/5)×12,000=4,800

- Rent:

Step 5: Summarize Total Costs

- Product X:

- Total Costs = Direct Costs + Indirect Costs

- Total Costs = $80,000 (direct) + $7,200 (rent) + $3,600 (utilities) + $7,200 (admin salaries) = $98,000

- Product Y:

- Total Costs = $65,000 (direct) + $4,800 (rent) + $2,400 (utilities) + $4,800 (admin salaries) = $77,000

Step 6: Analyze Profitability

Assuming the following selling prices:

- Selling Price of Product X: $120,000

- Selling Price of Product Y: $90,000

Profit Calculation:

- Product X:

- Profit = Selling Price – Total Costs

- Profit = $120,000 – $98,000 = $22,000

- Product Y:

- Profit = Selling Price – Total Costs

- Profit = $90,000 – $77,000 = $13,000

Conclusion

ABC Manufacturing Ltd. successfully allocated direct costs directly to products and apportioned indirect costs based on logical bases. The analysis revealed that both products were profitable, but Product X generated a higher profit than Product Y. This information will help management make informed decisions regarding production and marketing strategies.

Learning Points

- Accurate allocation and apportionment of expenses are critical for understanding the true cost and profitability of products.

- Selecting appropriate bases for apportionment is essential for ensuring fair distribution of indirect costs.

- Regularly reviewing these processes can enhance financial decision-making.

White paper on Allocation and Apportionment of expenses

Executive Summary

Effective cost management is crucial for organizations striving to enhance profitability and operational efficiency. The allocation and apportionment of expenses is a vital process that enables businesses to accurately assess the costs associated with their products, services, and departments. This white paper provides an in-depth examination of the principles, methodologies, and importance of expense allocation and apportionment, along with best practices for implementation.

Table of Contents

- Introduction

- Definitions

- Importance of Allocation and Apportionment

- Methods of Allocation and Apportionment

- Steps in the Allocation and Apportionment Process

- Challenges and Considerations

- Best Practices

- Conclusion

- References

1. Introduction

Organizations face increasing pressure to optimize costs and maximize profitability. One of the fundamental aspects of financial management is the allocation and apportionment of expenses, which allows organizations to understand the true cost of their operations. By accurately allocating costs, organizations can make informed decisions regarding pricing, budgeting, and resource management.

2. Definitions

- Allocation: The process of assigning direct costs (e.g., materials, labor) to specific departments, products, or projects.

- Apportionment: The distribution of indirect costs (e.g., utilities, administrative expenses) among various departments or products based on predetermined criteria or allocation bases.

3. Importance of Allocation and Apportionment

- Cost Control: Understanding where resources are consumed helps organizations identify areas for cost reduction.

- Profitability Analysis: Accurate cost assessments enable better evaluation of product and departmental profitability.

- Budgeting: Proper expense allocation informs the budgeting process, ensuring that resources are allocated efficiently.

- Strategic Decision-Making: Insight into cost structures supports informed decision-making regarding investments and pricing strategies.

4. Methods of Allocation and Apportionment

Organizations can employ various methods for allocation and apportionment, including:

- Direct Allocation: Assigning direct costs entirely to a specific product or department.

- Activity-Based Costing (ABC): Allocating costs based on the activities that drive expenses, providing a more accurate picture of resource consumption.

- Percentage of Completion: Commonly used in project management, this method allocates costs based on the percentage of the project completed.

- Traditional Methods: Using simple bases such as headcount, machine hours, or floor space for apportioning indirect costs.

5. Steps in the Allocation and Apportionment Process

- Identify Costs: Distinguish between direct and indirect costs.

- Establish Policies: Develop clear allocation and apportionment policies that align with organizational objectives.

- Select Allocation Bases: Choose appropriate bases for distributing indirect costs.

- Calculate Allocations and Apportionments: Apply the chosen methods to determine allocated and apportioned amounts.

- Record and Document: Ensure accurate documentation and recording of all transactions.

- Review and Adjust: Regularly review practices to ensure they remain relevant and effective.

6. Challenges and Considerations

- Complexity: As organizations grow, the complexity of expense allocation increases, making it challenging to maintain accurate records.

- Subjectivity: The selection of allocation bases can introduce subjectivity, potentially leading to disputes over cost distributions.

- Compliance: Organizations must ensure that their allocation methods comply with relevant accounting standards and regulations.

7. Best Practices

- Consistency: Apply allocation methods consistently across reporting periods to ensure comparability.

- Transparency: Maintain clear documentation of the rationale behind allocation decisions to facilitate audits and reviews.

- Regular Review: Periodically assess and adjust allocation methods to reflect changes in operations or cost structures.

- Engagement: Involve key stakeholders in the development of allocation policies to ensure buy-in and adherence.

8. Conclusion

The allocation and apportionment of expenses are essential processes that provide organizations with valuable insights into their cost structures and profitability. By implementing best practices and leveraging appropriate methodologies, businesses can enhance their financial management capabilities, improve decision-making, and ultimately drive growth.

9. References

- Horngren, C. T., Sundem, G. L., & Stratton, W. O. (2014). Introduction to Management Accounting. Pearson.

- Drury, C. (2013). Management and Cost Accounting. Cengage Learning.

- Kaplan, R. S., & Cooper, R. (1998). Cost & Effect: Using Integrated Cost Systems to Drive Profitability and Performance. Harvard Business School Press.

This white paper provides a comprehensive overview of the allocation and apportionment of expenses.

Industrial Application of Allocation and Apportionment of expenses

The allocation and apportionment of expenses are critical in various industrial applications, allowing organizations to accurately assess costs, optimize operations, and improve profitability. Below are some key industrial applications:

1. Manufacturing Industry

- Cost of Goods Sold (COGS): Allocation of direct materials and labor costs directly to products helps in calculating COGS accurately. Apportionment of overhead costs (like utilities and factory rent) among different products is essential for pricing strategies and profit analysis.

- Activity-Based Costing (ABC): Many manufacturers implement ABC to allocate costs based on activities that consume resources, providing more accurate product costing and identifying non-value-adding activities.

2. Construction Industry

- Project Costing: In construction, direct costs (materials, labor) are allocated to specific projects, while indirect costs (administrative expenses, equipment depreciation) are apportioned based on project size or duration.

- Bid Preparation: Accurate allocation and apportionment of costs enable construction companies to prepare competitive bids and forecast profitability effectively.

3. Healthcare Sector

- Departmental Budgeting: Hospitals allocate costs to various departments (e.g., surgery, radiology) to assess their financial performance. Indirect costs, such as administrative salaries, are apportioned based on patient volume or service hours.

- Cost-Effectiveness Analysis: Allocation of costs related to patient care services allows healthcare providers to evaluate the cost-effectiveness of different treatments or interventions.

4. Retail Industry

- Inventory Management: Retailers allocate costs related to inventory (purchase costs, storage) to individual products, helping them understand profit margins and optimize pricing strategies.

- Store Performance Analysis: Apportioning costs like utilities and rent among multiple retail locations helps assess the profitability of each store, leading to informed decisions regarding expansion or closure.

5. Telecommunications

- Service Pricing: Telecommunications companies allocate direct costs (like infrastructure investments) to specific services (e.g., internet, phone) while apportioning indirect costs (administrative and customer service expenses) based on customer usage or revenue.

- Profitability Analysis: By accurately assessing the costs associated with different services, companies can refine their pricing models and service offerings to enhance profitability.

6. Energy and Utilities

- Rate Making: Energy companies allocate production costs (fuel, labor) to specific energy types (electricity, gas) while apportioning indirect costs (infrastructure maintenance) among different customer classes (residential, commercial, industrial).

- Regulatory Compliance: Accurate allocation and apportionment are crucial for compliance with regulatory requirements, ensuring transparency in how costs are assigned to different consumer categories.

7. Transportation and Logistics

- Freight Costing: Logistics companies allocate direct costs associated with shipping and handling to specific shipments while apportioning indirect costs (administration, warehousing) based on shipment volume or distance.

- Performance Metrics: Understanding the true cost of transportation helps firms assess performance metrics, optimize routes, and negotiate better contracts with clients.

8. Information Technology

- Project Management: IT firms allocate costs of development projects (staff salaries, software licenses) and apportion indirect costs (office expenses) among various projects to evaluate profitability.

- Service Level Agreements (SLAs): For IT service providers, accurately allocating and apportioning costs is essential for setting pricing in SLAs, ensuring that service costs reflect the actual resources consumed.

Summary

The industrial applications of allocation and apportionment of expenses are diverse and critical for operational efficiency, strategic decision-making, and financial performance assessment. By implementing effective allocation and apportionment methods, industries can gain a clearer understanding of their cost structures, optimize resource usage, and enhance profitability.

- Historical cost

- Constant purchasing power

- Management

- Tax

- Audit

- Budget

- Cost

- Forensic

- Financial

- Fund

- Governmental

- Management

- Social

- Tax

- Demographics of the world

- Demographic transition

- Estimates of historical world population

- Population growth

- Population momentum

- Projections of population growth

- World population

- Population decline

- Population density Physiological density

- Population dynamics

- Population model

- Population pyramid

- Biocapacity

- Carrying capacity

- I = P × A × T

- Kaya identity

- Malthusian growth model

- Overshoot (population)

- World3 model

- Eugenics

- Dysgenics

- Human overpopulation Malthusian catastrophe

- Human population planning Compulsory sterilization

- Family planning

- One-child policy

- Two-child policy

- Overconsumption

- Political demography

- Population ethics Antinatalism

- Mere addition paradox

- Natalism

- Non-identity problem

- Reproductive rights

- Sustainable population

- Zero population growth

- 7 Billion Actions

- Church of Euthanasia

- International Conference on Population and Development

- Population Action International

- Population Connection

- Population Matters

- United Nations Population Fund

- United Nations world population conferences

- Voluntary Human Extinction Movement

- World Population Conference

- World Population Day

- World Population Foundation

- Approval voting Combined approval voting

- Unified primary

- Borda count

- Bucklin voting

- Condorcet methods Copeland’s method

- Dodgson’s method

- Kemeny–Young method

- Minimax Condorcet method

- Nanson’s method

- Ranked pairs

- Schulze method

- Exhaustive ballot

- First-past-the-post voting

- Instant-runoff voting Coombs’ method

- Contingent vote

- Supplementary vote

- Simple majoritarianism

- Plurality

- Positional voting system

- Score voting

- STAR voting

- Two-round system

- Graduated majority judgment

- Mixed-member

- Mixed single vote

- Party-list

- Proportional approval voting

- Rural–urban

- Sequential proportional approval voting

- Single transferable vote CPO-STV

- Hare-Clark

- Schulze STV

- Spare vote

- Indirect single transferable voting

- Parallel voting

- MMP

- Additional member system

- Alternative vote plus

- Mixed single vote

- Mixed ballot transferable vote

- Scorporo

- Vote linkage mixed system

- Condorcet winner criterion

- Condorcet loser criterion

- Consistency criterion

- Independence of clones

- Independence of irrelevant alternatives

- Independence of Smith-dominated alternatives

- Later-no-harm criterion

- Majority criterion

- Majority loser criterion

- Monotonicity criterion

- Mutual majority criterion

- Participation criterion

- Plurality criterion

- Resolvability criterion

- Reversal symmetry

- Smith criterion

- Seats-to-votes ratio

- Comparison of voting systems

- Voting systems by country