Book keeping- Bookkeeping is the process of recording, organizing, and maintaining financial transactions and records for a business or individual. It is a fundamental aspect of accounting and plays a crucial role in managing the financial health of an organization. Here are some key aspects of bookkeeping:

- Recording Transactions: Bookkeepers record financial transactions, including sales, purchases, expenses, and payments, in a systematic and organized manner. Transactions are typically recorded using accounting software or in physical ledgers.

- Double-Entry System: Bookkeeping follows the double-entry accounting system, where each transaction has two equal and opposite entries. For example, when a sale is made, revenue increases (credit), and an asset (like cash or accounts receivable) also increases (debit).

- Chart of Accounts: Bookkeepers use a chart of accounts, which is a list of all the accounts used to record financial transactions. This includes assets, liabilities, equity, revenue, and expense accounts.

- Journals and Ledgers: Transactions are first recorded in journals, and then they are transferred to the appropriate ledger accounts. Common types of journals include the sales journal, purchase journal, and general journal. Ledgers are used to maintain account balances.

- Bank Reconciliation: Bookkeepers reconcile bank statements with the company’s financial records to ensure that all transactions match. Any discrepancies are investigated and corrected.

- Financial Statements: Bookkeepers play a crucial role in preparing financial statements such as the balance sheet, income statement (profit and loss statement), and cash flow statement. These statements provide a snapshot of the financial position and performance of a business.

- Compliance: Accurate bookkeeping is essential for tax compliance. Bookkeepers ensure that all financial transactions are properly documented and that the business meets its tax obligations.

- Audit Trail: Proper bookkeeping creates an audit trail, making it possible to track and verify all financial transactions. This is important for both internal and external audits.

- Budgeting and Planning: Bookkeepers often assist in budgeting and financial planning by providing historical financial data and insights into income and expenses.

- Accuracy and Attention to Detail: Bookkeepers must be meticulous and accurate in their work because even small errors can lead to significant financial discrepancies.

While bookkeeping is distinct from accounting, it provides the essential foundation upon which accounting is built. Accountants use the records maintained by bookkeepers to analyze financial data, make financial decisions, and prepare financial reports. Small businesses may have a dedicated bookkeeper, while larger organizations typically have accounting departments with bookkeepers as part of the team.

What is Book keeping

Bookkeeping is the process of systematically recording and organizing financial transactions of a business or an individual. It involves keeping a detailed, accurate, and organized record of all financial activities, including income, expenses, assets, and liabilities. The primary purpose of bookkeeping is to create a comprehensive financial record that can be used for various purposes, such as financial analysis, tax preparation, and making informed business decisions.

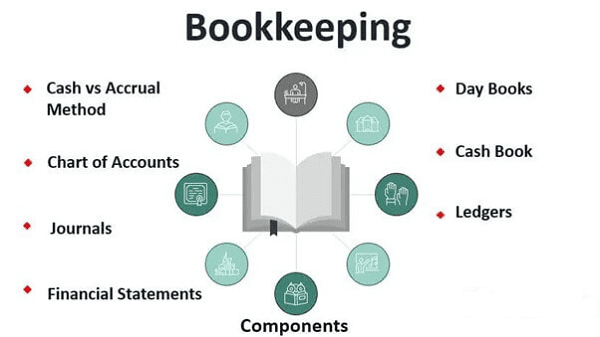

Here are the key components and concepts related to bookkeeping:

- Recording Transactions: Bookkeepers document every financial transaction as they occur. This includes sales, purchases, payments, receipts, loans, and more. Each transaction is recorded with specific details, such as date, description, amount, and accounts affected.

- Double-Entry System: Bookkeeping typically follows the double-entry accounting system, which means that every transaction has at least two entries: a debit and a credit. Debits and credits are recorded in corresponding accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

- Chart of Accounts: Bookkeepers use a chart of accounts, which is a structured list of various financial accounts where transactions are recorded. These accounts include assets (e.g., cash, accounts receivable), liabilities (e.g., loans, accounts payable), equity (e.g., owner’s equity), income (e.g., revenue), and expenses (e.g., rent, utilities).

- Journals and Ledgers: Transactions are first recorded in journals, which are chronological records of financial events. These entries are then posted to ledgers, which are organized accounts summarizing all related transactions.

- Bank Reconciliation: Regular bank reconciliation is a part of bookkeeping. This involves comparing the company’s financial records with bank statements to ensure that they match. Any discrepancies or errors are investigated and corrected.

- Financial Statements: The information collected through bookkeeping is used to prepare financial statements, including the balance sheet, income statement (profit and loss statement), and cash flow statement. These statements provide an overview of an entity’s financial health and performance.

- Tax Compliance: Proper bookkeeping is essential for meeting tax obligations. It helps in accurately calculating and reporting income, deductions, and credits for tax purposes.

- Financial Analysis: Bookkeeping data can be used for financial analysis, budgeting, forecasting, and making informed financial decisions. It provides insights into cash flow, profitability, and overall financial stability.

- Audit Trail: A well-maintained set of books creates an audit trail that allows for the verification of financial transactions. This is crucial for internal reviews, external audits, and regulatory compliance.

- Accuracy and Detail: Attention to detail and accuracy are critical in bookkeeping to ensure that financial records are reliable and free from errors or discrepancies.

Bookkeeping can be done manually using paper ledgers or electronically with accounting software. Many businesses, especially larger ones, rely on specialized accounting software to streamline and automate the bookkeeping process. Small businesses may handle their bookkeeping internally, while larger organizations often employ professional bookkeepers or outsource the task to accounting firms.

Who is Required Book keeping

Bookkeeping is required for various individuals and entities to maintain accurate financial records and fulfill legal and financial reporting obligations. Here are some groups and situations where bookkeeping is typically required:

- Small and Large Businesses: All businesses, regardless of their size, are required to keep accurate financial records. Small businesses may handle bookkeeping in-house, while larger businesses often have dedicated accounting departments or hire professional bookkeepers.

- Sole Proprietors: Sole proprietors, who operate their businesses as individuals, are legally obligated to maintain financial records for tax reporting purposes. Accurate bookkeeping helps them calculate their taxable income.

- Partnerships: Partnerships, where two or more individuals or entities join to run a business, must keep detailed financial records to allocate profits and losses among partners accurately.

- Corporations: Corporations are legally required to maintain extensive financial records for compliance with corporate laws and regulations. Accurate financial records are essential for shareholder reporting and meeting legal requirements.

- Limited Liability Companies (LLCs): Like corporations, LLCs must maintain financial records to comply with state laws and meet reporting obligations to members or owners.

- Nonprofit Organizations: Nonprofits are required to keep accurate financial records to track donations, grants, expenses, and other financial transactions. These records are necessary for maintaining tax-exempt status and reporting to donors and government agencies.

- Tax Compliance: Individuals and businesses must maintain financial records for tax compliance purposes. Accurate bookkeeping ensures that income, deductions, and credits are properly reported to tax authorities.

- Audits and Financial Reviews: Entities subject to audits, whether by internal audit teams, external auditors, or regulatory agencies, must maintain comprehensive financial records to facilitate the audit process and demonstrate compliance with financial regulations.

- Financial Institutions: Banks and other financial institutions are required to maintain detailed financial records as part of their regulatory compliance and risk management processes.

- Legal and Regulatory Requirements: Various local, state, and federal laws and regulations may require specific entities or industries to maintain certain financial records. Compliance with these requirements often necessitates accurate bookkeeping.

- Contractual Obligations: Some contracts or agreements with third parties, such as lenders or investors, may require entities to maintain and provide financial records as part of their contractual obligations.

- Personal Financial Planning: Individuals may choose to maintain personal financial records for budgeting, financial planning, and investment purposes.

In summary, bookkeeping is essential for individuals, businesses, and organizations to ensure financial accuracy, meet legal requirements, make informed financial decisions, and maintain transparency in financial matters. Accurate bookkeeping helps in tax compliance, financial analysis, and the overall financial health of an entity. Depending on the specific circumstances and legal requirements, the extent and complexity of bookkeeping may vary.

When is Required Book keeping

Required bookkeeping is an ongoing process that occurs regularly throughout the fiscal year or accounting period. It involves recording and maintaining financial transactions as they happen. Here are some key aspects of when and how required bookkeeping takes place:

- Daily Transactions: Many businesses and organizations engage in bookkeeping on a daily basis. This includes recording daily sales, expenses, and other financial activities. For instance, a retail store may record each sale as it happens, while an organization might record daily expenses, such as utility bills or payroll.

- Weekly or Biweekly: Some businesses may choose to perform bookkeeping on a weekly or biweekly basis. This is common for smaller businesses or organizations with relatively lower transaction volumes. They consolidate transactions from a short period into their accounting records.

- Monthly: Monthly bookkeeping is a common practice for many businesses. At the end of each month, financial transactions are reconciled, recorded, and summarized in financial statements. This helps in monitoring financial performance and preparing monthly reports.

- Quarterly: Certain businesses and organizations, especially those with less frequent transactions or simpler financial structures, may opt for quarterly bookkeeping. Quarterly financial statements are prepared to provide a summary of the financial status and performance for the preceding three months.

- Annually: Regardless of the frequency of other bookkeeping tasks, all entities typically engage in annual bookkeeping to prepare year-end financial statements. These statements are essential for tax purposes and for reporting financial results to stakeholders.

- Tax Reporting Deadlines: For tax compliance, businesses and individuals must maintain accurate financial records and prepare financial statements based on the tax year. The timing for tax reporting and filing varies by jurisdiction and entity type but often falls on an annual basis. Quarterly or estimated tax payments may also be required in some cases.

- Audit and Review Cycles: Entities subject to audits, either by internal or external auditors, will have specific timelines for bookkeeping and financial reporting based on the audit schedule. This may involve regular updates throughout the year to ensure accuracy and compliance.

- Continuous Monitoring: Beyond these regular intervals, some businesses engage in continuous monitoring and reconciliation of financial transactions. This approach helps identify and address issues promptly.

The exact timing and frequency of required bookkeeping depend on the specific needs and circumstances of the entity or individual. Factors such as transaction volume, industry regulations, reporting requirements, and internal accounting practices influence the bookkeeping schedule. Additionally, advances in accounting software and technology have made it easier to maintain real-time financial records, allowing for more frequent updates and analysis.

Ultimately, the goal of required bookkeeping is to ensure that financial records are accurate, up-to-date, and compliant with legal and regulatory obligations, making it an ongoing and essential process in the financial management of any entity.

Where is Required Book keeping

Required bookkeeping can take place in various locations, depending on the preferences and circumstances of the individual or business. Here are some common places where required bookkeeping is typically carried out:

- In-House: Many businesses and individuals choose to perform required bookkeeping in-house. This means that they maintain their financial records using accounting software or manual ledger systems within their own premises. This approach allows for direct control over financial data and confidentiality.

- Professional Bookkeeping Services: Some businesses, particularly smaller ones, may hire professional bookkeepers to handle their required bookkeeping tasks. These bookkeepers can work on-site or remotely and are responsible for maintaining financial records, reconciling accounts, and ensuring compliance with accounting and tax regulations.

- Accounting Firms: Larger businesses or those with more complex financial transactions may engage accounting firms or certified public accountants (CPAs) to handle their bookkeeping needs. These firms have the expertise and resources to manage extensive financial records and ensure compliance.

- Outsourcing: Some entities choose to outsource their bookkeeping needs to specialized outsourcing companies or firms. Outsourcing can be a cost-effective solution for organizations that want to focus on their core activities while leaving financial management to experts.

- Cloud-Based Accounting Software: Many businesses and individuals use cloud-based accounting software platforms like QuickBooks, Xero, or FreshBooks to manage their financial records. These platforms allow for real-time access to financial data from anywhere with an internet connection and often include features for invoicing, expense tracking, and financial reporting.

- Home Office: Small business owners and self-employed individuals may maintain their required bookkeeping records in a dedicated home office or workspace. They can use accounting software or manual methods to record financial transactions.

- Co-Working Spaces: Some entrepreneurs and freelancers who operate from co-working spaces may manage their bookkeeping tasks from these shared work environments, often with the assistance of cloud-based accounting tools.

- Virtual Offices: Virtual offices or virtual business addresses may be used by businesses that operate remotely. These entities may handle their bookkeeping remotely as well, using cloud-based software and virtual bookkeeping services.

- Secure Online Platforms: Online banking and financial management platforms offered by banks and financial institutions provide a secure environment for tracking transactions, managing accounts, and reconciling balances.

The choice of where to conduct required bookkeeping depends on factors such as the entity’s size, complexity, budget, and the availability of skilled personnel. Additionally, regulatory requirements and industry-specific standards can also influence the location and method of bookkeeping. Regardless of where bookkeeping occurs, it is essential to ensure that financial records are accurate, well-organized, and compliant with legal and tax obligations.

How is Required Book keeping

Required bookkeeping involves a systematic process for recording, organizing, and maintaining financial transactions and records accurately. Here’s a step-by-step guide on how required bookkeeping is typically done:

- Gather Financial Documents:

- Collect all relevant financial documents, including invoices, receipts, bank statements, purchase orders, sales records, expense reports, and any other documents related to financial transactions.

- Set Up a Chart of Accounts:

- Establish a chart of accounts, which is a structured list of financial categories or accounts used to categorize transactions. Common categories include assets, liabilities, equity, revenue, and expenses.

- Choose a Bookkeeping System:

- Decide whether to use manual bookkeeping methods (such as paper ledgers) or accounting software. Most businesses opt for accounting software because it simplifies the process and provides tools for automation.

- Record Financial Transactions:

- For each financial transaction, record the relevant details, including the date, description, transaction amount, and the accounts affected (debit and credit).

- Follow the double-entry accounting system, ensuring that each transaction has equal debits and credits to maintain balance in the books.

- Reconciliation:

- Regularly reconcile financial records with external documents, such as bank statements. Ensure that all transactions match and resolve any discrepancies.

- Generate Financial Statements:

- Use the recorded transactions to prepare key financial statements:

- Balance Sheet: Shows an entity’s financial position, including assets, liabilities, and equity, at a specific point in time.

- Income Statement (Profit and Loss Statement): Summarizes revenues, expenses, and net income or loss over a specific period.

- Cash Flow Statement: Tracks cash inflows and outflows to assess liquidity.

- Use the recorded transactions to prepare key financial statements:

- Tax Compliance:

- Ensure that all financial records are in compliance with tax laws and regulations. This includes tracking deductible expenses and calculating taxable income.

- Periodic Reporting:

- Depending on your business’s needs and legal requirements, generate and review financial reports regularly. This could be on a daily, weekly, monthly, quarterly, or annual basis.

- Backup and Data Security:

- Implement data backup and security measures to protect financial records from loss, theft, or data breaches. Ensure that your financial data is stored securely.

- Audit Preparation:

- Maintain organized financial records to facilitate internal or external audits, if required.

- Financial Analysis:

- Analyze financial data to make informed decisions, monitor financial performance, and identify areas for improvement.

- Compliance and Documentation:

- Keep records of any financial documents, receipts, invoices, and other relevant paperwork as evidence of transactions and compliance with financial regulations.

- Training and Professional Guidance:

- If you are not experienced in bookkeeping, consider training or consulting with a professional bookkeeper or accountant to ensure accuracy and compliance with accounting standards.

- Adapt to Changes:

- Stay up-to-date with changes in accounting standards, tax laws, and industry regulations to ensure that your bookkeeping practices remain compliant and accurate.

The specific process and frequency of required bookkeeping may vary depending on the size and complexity of the business or entity, as well as its industry and regulatory requirements. Many businesses opt for accounting software or professional bookkeeping services to streamline the process and reduce the risk of errors.

Case Study on Book keeping

Sarah’s Bakery

Background: Sarah is a passionate baker who decided to turn her hobby into a small business by opening a bakery in her local neighborhood. She specializes in custom cakes, pastries, and other baked goods. Her business, “Sarah’s Bakery,” started as a home-based venture, but it quickly gained popularity, and she decided to rent a small storefront.

Challenges: Sarah initially underestimated the importance of proper bookkeeping. She was focused on baking delicious treats and serving customers, but she neglected to keep detailed financial records. As her business grew, she began facing several challenges:

- Tax Confusion: Sarah struggled with calculating and paying her taxes accurately because she didn’t have a clear record of her income and expenses.

- Cash Flow Issues: She experienced cash flow problems and didn’t know where her money was going. She often dipped into her personal savings to cover business expenses.

- Supplier Confusion: Sarah lost track of payments to suppliers and sometimes paid invoices late, affecting her relationships with key suppliers.

- Profitability Concerns: She couldn’t determine whether her business was profitable or not because she didn’t have a clear picture of her costs and revenues.

Solution: Recognizing the need for proper bookkeeping, Sarah decided to take the following steps:

- Implement Accounting Software: She invested in accounting software, which helped her organize her financial transactions efficiently. This software allowed her to record sales, expenses, and payments easily.

- Establish a Chart of Accounts: Sarah set up a chart of accounts tailored to her bakery business, including categories for ingredients, equipment, sales, and operating expenses.

- Record Transactions Daily: She made it a habit to record every financial transaction daily, ensuring that no income or expense was overlooked.

- Reconciliation: Sarah reconciled her bank statements with her accounting records every month to identify and rectify discrepancies.

- Monthly Financial Statements: She began generating monthly income statements to track her sales and expenses. This helped her analyze her bakery’s profitability and make informed decisions.

- Tax Compliance: With accurate financial records, Sarah was able to calculate and pay her taxes correctly and on time, avoiding penalties and reducing her tax liability.

Results: Sarah’s efforts in implementing proper bookkeeping practices led to several positive outcomes:

- Improved Cash Flow: She gained better control over her finances, and cash flow issues became less frequent.

- Supplier Relationships: Paying suppliers on time improved her relationships with key suppliers, often leading to discounts and better terms.

- Profitability Insights: Sarah could now see which products were most profitable and made data-driven decisions about her menu and pricing.

- Tax Savings: Accurate tax reporting helped her save money by minimizing her tax liability and avoiding penalties.

- Business Growth: Sarah’s Bakery continued to grow steadily, attracting more customers and expanding her product offerings.

This case study highlights how proper bookkeeping can transform a small business’s financial health, enhance decision-making, and contribute to long-term success. By maintaining accurate financial records, Sarah was able to overcome initial challenges and achieve her goals in the bakery business.

White paper on Book keeping

Title: “The Importance of Effective Bookkeeping: A Comprehensive White Paper”

Executive Summary: This white paper aims to provide a comprehensive understanding of the significance of effective bookkeeping in business and financial management. Bookkeeping is the foundation upon which sound financial decisions are built, and its role in maintaining compliance, ensuring accurate financial reporting, and promoting business growth cannot be overstated. In this white paper, we will explore the principles, best practices, and benefits of bookkeeping, as well as the tools and technology available to streamline the process.

Table of Contents:

- Introduction

- Defining Bookkeeping

- The Role of Bookkeeping in Financial Management

- Objectives of the White Paper

- The Fundamentals of Bookkeeping

- Double-Entry Accounting

- The Chart of Accounts

- Journals and Ledgers

- The Importance of Accurate Bookkeeping

- Compliance and Legal Requirements

- Tax Reporting and Compliance

- Decision-Making and Financial Analysis

- Benefits of Effective Bookkeeping

- Improved Cash Flow Management

- Enhanced Financial Transparency

- Informed Business Decisions

- Building Investor and Lender Confidence

- Methods and Tools for Bookkeeping

- Manual Bookkeeping vs. Accounting Software

- Choosing the Right Accounting Software

- Cloud-Based Bookkeeping Solutions

- Best Practices in Bookkeeping

- Daily, Weekly, and Monthly Tasks

- Reconciliation and Audit Trail

- Financial Reporting and Analysis

- Common Bookkeeping Mistakes and How to Avoid Them

- Data Entry Errors

- Neglecting Bank Reconciliation

- Inadequate Record Keeping

- Failing to Plan for Taxes

- Outsourcing and Professional Bookkeeping Services

- When to Consider Outsourcing

- Benefits of Professional Bookkeeping

- Case Studies

- Real-world examples illustrating the impact of effective and ineffective bookkeeping practices.

- The Future of Bookkeeping

- Technological Advances in Bookkeeping

- AI and Automation in Bookkeeping

- Evolving Roles of Bookkeepers

- Conclusion

- Recap of Key Takeaways

- The Ongoing Importance of Effective Bookkeeping

- Resources

- References and Further Reading

- Recommended Accounting Software

Conclusion: Effective bookkeeping is a cornerstone of financial stability and success for businesses and individuals alike. This white paper has explored the principles, practices, and benefits of bookkeeping, emphasizing its role in ensuring compliance, informed decision-making, and overall financial well-being. As technology continues to advance, bookkeeping practices are evolving, offering new opportunities for efficiency and accuracy. However, the core principles of accuracy, transparency, and accountability remain as vital as ever in the world of finance. By recognizing the significance of effective bookkeeping and implementing best practices, businesses and individuals can achieve financial clarity and confidently navigate their financial journeys.