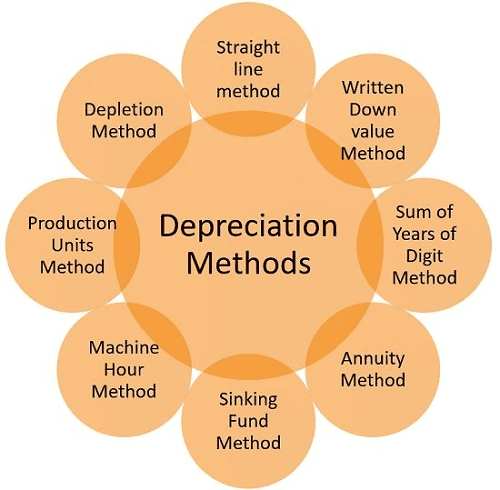

Methods of depreciation- Depreciation refers to the reduction in the value of an asset over time, particularly due to wear and tear. It is commonly used in accounting to allocate the cost of tangible assets over their useful life. Several methods are used to calculate depreciation, including:

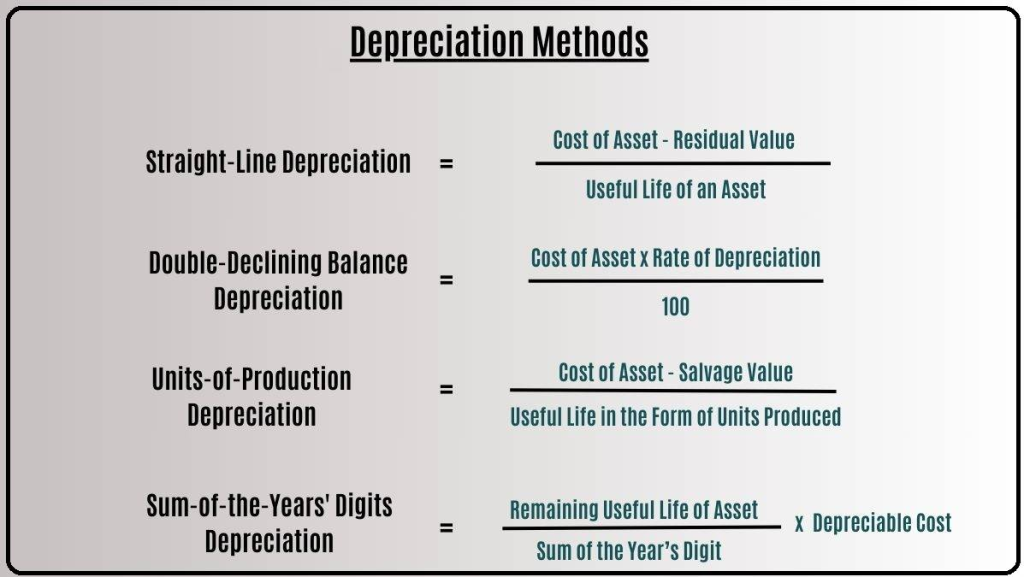

1. Straight-Line Depreciation

- Description: This is the simplest and most commonly used method. The cost of the asset is evenly distributed over its useful life.

- Formula: Annual Depreciation=Cost of Asset−Salvage Value/Useful Life

- Example: If an asset costs $10,000, has a salvage value of $1,000, and a useful life of 5 years, the annual depreciation would be: 10,000−1,000/5=1,800 per year

2. Declining Balance Depreciation (Double-Declining Balance Method)

- Description: This method accelerates depreciation, meaning more expense is recognized in the earlier years of the asset’s life.

- Formula: Depreciation Expense=2×Straight-Line Depreciation Rate×Book Value at Beginning of Year

- Example: For an asset with a 5-year useful life, the straight-line depreciation rate is 20% (1/5). In the first year, double this rate (40%) is applied to the book value.

3. Sum-of-the-Years’ Digits (SYD) Depreciation

- Description: This method assigns more depreciation in the early years of the asset’s life, but at a slower rate than the declining balance method.

- Formula: Depreciation Expense=Remaining Life of Asset/Sum of the Years×(Cost – Salvage Value) Where “Sum of the Years” is calculated by adding the digits of the years of the asset’s useful life. For example, for a 5-year life, sum = 1+2+3+4+5 = 15.

4. Units of Production Depreciation

- Description: This method is based on the actual usage, production, or output of the asset rather than a set time period.

- Formula: Depreciation Expense=(Cost – Salvage Value)/Total Estimated Production×Units Produced in Period

- Example: If a machine is expected to produce 100,000 units in its life and costs $50,000 with a salvage value of $5,000, and it produces 10,000 units in the first year, depreciation is: 50,000−5,000/100,000×10,000=4,500 for the first year.

5. Modified Accelerated Cost Recovery System (MACRS)

- Description: This is the depreciation method used in the U.S. for tax purposes. It allows for a greater tax deduction in the early years of an asset’s life. MACRS uses a set of depreciation rates published by the IRS.

- Application: Typically used for tangible personal and real property placed in service after 1986.

Each method serves different purposes, depending on the nature of the asset, accounting policies, and financial reporting goals.

What is Required Methods of depreciation

“Required methods of depreciation” typically refers to the methods mandated or recommended by accounting standards or tax authorities for certain types of assets or financial reporting purposes. Different organizations may require specific methods based on regulations, industry practices, or tax policies. Here are some examples of what can be considered required or standard depreciation methods in various contexts:

1. For Financial Reporting (GAAP/IFRS):

Under generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), companies are required to choose a depreciation method that most accurately reflects how the asset is used or how it loses value over time. The most common methods allowed are:

- Straight-Line Depreciation: Often required or preferred for financial reporting because of its simplicity and consistent expense allocation.

- Declining Balance or Double Declining Balance: Allowed for assets that depreciate more quickly in the earlier years of their life.

- Units of Production: Required for assets whose wear and tear is closely related to usage rather than time (e.g., machinery or vehicles).

- Component Depreciation (IFRS specific): IFRS requires that different components of an asset be depreciated separately if they have different useful lives or depreciation patterns.

2. For Tax Reporting (Tax Codes):

Tax authorities may require or mandate specific methods of depreciation for the purpose of tax calculations:

- Modified Accelerated Cost Recovery System (MACRS): In the U.S., businesses are required to use MACRS for tax purposes. It allows accelerated depreciation and specifies different depreciation schedules based on asset class (e.g., 3-year, 5-year, or 7-year property).

- Accelerated Depreciation: Some tax systems encourage using faster depreciation methods like double declining balance to allow businesses to write off assets quickly and reduce taxable income.

3. For Public Sector Reporting:

In the public sector or for governmental financial reporting, certain regulations may require the use of specific depreciation methods:

- Straight-Line Method: Often required by public sector entities because it provides a consistent and transparent allocation of expenses over the useful life of an asset.

4. Industry-Specific Requirements:

Some industries may have required or standard depreciation methods due to the nature of their assets:

- Mining, Oil & Gas: Units of production depreciation may be required, as asset depletion directly correlates to the amount of resource extraction.

- Utilities and Infrastructure: Straight-line depreciation is often required due to the long-term nature of assets.

5. Regulatory Requirements (e.g., ISO/GAAP Compliance):

Organizations that are regulated by industry standards (like ISO or specific financial regulations) may be required to follow a particular depreciation method to ensure compliance with financial reporting standards. For instance:

- Depreciation schedules must align with industry standards as part of quality management or financial reporting systems.

In summary, while different depreciation methods may be allowed, the “required” method often depends on the governing financial reporting standards (GAAP, IFRS), tax regulations (MACRS), or industry-specific rules. Organizations must follow the method that aligns with the regulatory environment they operate in.

Who is Required Methods of depreciation

The “required methods of depreciation” are typically mandated or recommended by governing authorities, organizations, or institutions depending on the context. The requirement to use specific depreciation methods usually comes from the following entities:

1. Accounting Standards Bodies:

- Generally Accepted Accounting Principles (GAAP): In the U.S., GAAP is established by the Financial Accounting Standards Board (FASB). GAAP provides guidelines for financial reporting and dictates that companies use depreciation methods that best reflect the usage of their assets (commonly, straight-line depreciation).

- International Financial Reporting Standards (IFRS): Set by the International Accounting Standards Board (IASB), IFRS governs international financial reporting and may require component depreciation in some cases. IFRS allows several methods but emphasizes using the method that most closely represents the consumption of the asset’s economic benefits.

2. Tax Authorities:

- Internal Revenue Service (IRS): In the U.S., the IRS mandates that businesses use the Modified Accelerated Cost Recovery System (MACRS) for tax purposes. This system specifies different depreciation rates and schedules based on asset classes.

- National Tax Authorities: In other countries, national tax agencies (e.g., HMRC in the UK, CRA in Canada) may have specific rules for depreciation that businesses must follow to calculate taxable income accurately. Many countries allow accelerated depreciation methods to incentivize investment.

3. Government and Public Sector Regulations:

- Public Sector Accounting Standards: Entities in the public sector may have to comply with specific governmental accounting standards, such as Governmental Accounting Standards Board (GASB) rules in the U.S. This might require using the straight-line depreciation method for transparency and consistency.

- Industry-Specific Regulatory Agencies: For example, in industries such as public utilities or transportation, regulatory bodies may require specific depreciation methods for reporting and rate-setting purposes.

4. Auditors and Regulatory Compliance Bodies:

- Auditing Firms: When conducting financial audits, auditors (e.g., from big-four accounting firms) ensure that companies are following appropriate depreciation methods in line with accounting standards like GAAP or IFRS. Auditors will flag any discrepancies between required and used methods.

- Securities and Exchange Commission (SEC): Publicly traded companies must comply with SEC regulations, which require adherence to GAAP for financial reporting. Depreciation methods used in financial statements need to be in line with these standards.

5. Industry-Specific Bodies:

Certain industries may have their own governing bodies or regulatory organizations that prescribe depreciation methods. For instance:

- Petroleum, Oil, and Gas: The American Petroleum Institute (API) or other sector-specific regulators may require units of production depreciation due to the nature of resource depletion.

- Construction and Manufacturing: Standards for capital equipment depreciation in these industries might be governed by ISO standards or other industry guidelines.

6. Companies’ Internal Policies:

Larger organizations or multinational corporations may have internal accounting policies that dictate the use of specific depreciation methods. These policies are designed to ensure compliance with external regulations (GAAP, IFRS, tax authorities) and provide consistency across all divisions and geographical locations.

Summary:

The requirement to use specific depreciation methods can come from:

- Accounting standards (GAAP, IFRS)

- Tax authorities (IRS, CRA, HMRC)

- Public sector regulations (GASB)

- Auditing firms and compliance bodies (SEC)

- Industry-specific bodies

When is Required Methods of depreciation

The “required methods of depreciation” are typically enforced or mandated at specific times or circumstances depending on the context, such as accounting standards, tax regulations, or specific industry guidelines. Below are the scenarios in which certain depreciation methods become required or relevant:

1. When Preparing Financial Statements (GAAP/IFRS Compliance):

- Annual or Quarterly Financial Reporting: Publicly traded companies and other entities preparing financial statements under GAAP or IFRS must select a depreciation method (e.g., straight-line, declining balance) at the time they acquire an asset. These methods should best reflect how the asset’s value decreases over time.

- When Recording New Assets: As soon as an asset is purchased and put into use, a depreciation method is required to allocate its cost over its useful life. The chosen method must comply with applicable accounting standards, such as GAAP in the U.S. or IFRS internationally.

- When Audited: During audits (whether internal or external), businesses are required to show that their chosen depreciation method aligns with their accounting policies and the applicable financial standards. Auditors will check compliance with the standards, and depreciation must be recorded consistently across reporting periods.

2. When Filing Taxes (Tax Regulations Compliance):

- At the End of a Fiscal Year: Companies are required to calculate depreciation as part of their annual tax filings. In the U.S., the IRS requires the use of the Modified Accelerated Cost Recovery System (MACRS) for most assets. This calculation impacts the taxable income and must be applied every year the asset is in use.

- Upon Acquiring Capital Assets: When a company purchases capital equipment or property, it is required to begin depreciating the asset according to tax regulations, using methods like MACRS or specific schedules defined by tax authorities.

- For Property or Real Estate Investments: Depreciation rules, particularly for real estate or equipment investments, are triggered at acquisition and affect tax filings every year thereafter.

3. When Required by Industry Regulations:

- Regulatory Reporting in Specific Industries: Industries like utilities, oil & gas, and manufacturing may require companies to use certain depreciation methods at the time assets are placed in service. For example, companies in the oil and gas industry may use the units of production method based on how resources are extracted.

- Rate-Setting and Tariff Justifications: In some industries (like utilities), regulatory bodies require depreciation calculations to justify rate increases or changes. The required method must be used whenever these calculations are submitted, often annually or when seeking regulatory approval for new pricing.

4. When Following Internal or Corporate Policies:

- Asset Acquisition: Internally, when a company acquires a new asset, they may be required to use a specific depreciation method in line with company policy. This policy will often be tied to ensuring compliance with external financial reporting (GAAP/IFRS) or tax rules.

- At the Beginning of a New Financial Period: When a new fiscal or financial period starts, depreciation of assets is calculated and recorded. The chosen method is required to continue for the remaining life of the asset unless justified changes are approved by the auditors or regulators.

5. When Required by Law or Regulations:

- Legal and Regulatory Requirements for Public Companies: Publicly listed companies must follow specific accounting standards like GAAP or IFRS when they file with regulatory bodies such as the Securities and Exchange Commission (SEC). Depreciation methods must be selected and followed according to these regulations for each reporting cycle (quarterly or annually).

- Compliance with Government Contracts: If a company holds government contracts, there may be depreciation requirements tied to the accounting of assets purchased or used for government-funded projects.

Summary of When Required Methods of Depreciation Apply:

- At the acquisition of an asset – The company must choose and apply a method as soon as the asset is put into service.

- During financial reporting periods – Required methods must be followed when preparing annual or quarterly financial statements, following GAAP or IFRS.

- At the end of each fiscal year for tax filings – Tax authorities (e.g., IRS) require specific methods like MACRS when filing tax returns.

- When audited or under regulatory scrutiny – Companies must demonstrate compliance with the required method during external or internal audits.

- For industry-specific reporting and regulatory submissions – Certain industries have set times for depreciation calculations, especially when tied to pricing, tariffs, or resource depletion (e.g., mining, oil & gas).

These timings ensure that depreciation is accurately and consistently reported, reflecting both financial and tax requirements.

Where is Required Methods of depreciation

The “required methods of depreciation” are enforced in specific contexts or jurisdictions depending on the governing body, tax authority, accounting standards, or industry regulations. Below are the key places or environments where required methods of depreciation apply:

1. Within Financial Reporting Systems (GAAP/IFRS Compliance)

- United States (GAAP – Generally Accepted Accounting Principles):

- Companies in the U.S. must follow GAAP, set by the Financial Accounting Standards Board (FASB), for financial reporting. The chosen depreciation method (e.g., straight-line or double-declining balance) must be compliant with these standards.

- Required in corporate financial statements, annual reports, and SEC filings (for publicly listed companies).

- International (IFRS – International Financial Reporting Standards):

- Companies operating outside the U.S. or with international operations often follow IFRS, set by the International Accounting Standards Board (IASB).

- IFRS governs financial reporting in regions like Europe, Asia, Africa, Australia, and many other countries. Depreciation methods, including component depreciation, are required under these standards for transparency and accuracy in asset valuation.

2. For Tax Purposes (Tax Authority Compliance)

- United States (IRS – Internal Revenue Service):

- For tax purposes, businesses must follow the Modified Accelerated Cost Recovery System (MACRS) as required by the IRS. This method determines how quickly depreciation can be taken for tax benefits.

- MACRS is applied to various asset classes (buildings, machinery, vehicles) for tax filings at the federal level and sometimes the state level in the U.S.

- United Kingdom (HMRC – Her Majesty’s Revenue and Customs):

- In the UK, companies are required to follow depreciation rules set by HMRC for tax purposes. The tax code might allow certain methods like capital allowances rather than traditional depreciation.

- Other Countries (Local Tax Authorities):

- Each country has its own tax depreciation rules and methods. For example, in Canada, companies must follow the Capital Cost Allowance (CCA) system, while in Australia, depreciation follows Australian Tax Office (ATO) guidelines.

- Businesses operating in India are required to follow depreciation methods as outlined in the Income Tax Act, which may allow for accelerated depreciation under certain circumstances.

3. In Specific Industries (Regulatory and Industry-Specific Requirements)

- Oil & Gas, Mining, and Natural Resources:

- Depreciation methods such as units of production are required in the oil and gas or mining industries, where asset depreciation is tied to resource extraction (e.g., wells or mines). Industry bodies like the American Petroleum Institute (API) or specific regulatory agencies mandate these methods.

- Utilities and Public Sector:

- Utilities and public sector companies may be required to use straight-line depreciation due to regulatory requirements by entities like the Federal Energy Regulatory Commission (FERC) or other public utility regulators.

- Depreciation schedules and methods are often filed with regulators to justify rate adjustments and ensure financial transparency.

4. In Government and Public Sector Reporting

- Government Agencies (GASB – Governmental Accounting Standards Board):

- Governmental entities and public sector organizations in the U.S. are required to follow GASB standards, which often mandate straight-line depreciation for assets. This applies to assets owned by federal, state, and local governments.

- International Public Sector Accounting Standards (IPSAS):

- In countries that follow IPSAS, government entities must use required depreciation methods for public assets like infrastructure, buildings, and equipment.

5. For Corporate and Internal Policy Compliance

- Internal Corporate Policies:

- Large corporations, particularly multinationals, may have internal accounting policies that dictate specific required depreciation methods to ensure consistency across global operations.

- These policies ensure compliance with local tax laws, GAAP, IFRS, and industry standards. Depreciation schedules are required when maintaining the company’s asset management or enterprise resource planning (ERP) systems.

6. For Auditing and Regulatory Compliance

- External Auditors:

- Auditors (e.g., from big-four accounting firms like Deloitte, PwC, Ernst & Young) require companies to use appropriate depreciation methods that align with standards such as GAAP or IFRS. Auditors assess compliance during financial audits and verify that depreciation methods are properly applied.

- Securities and Exchange Commission (SEC):

- Publicly traded companies listed on stock exchanges (e.g., NYSE, NASDAQ) in the U.S. are required to follow SEC regulations, which include using approved depreciation methods for financial disclosures.

Summary of Where Required Methods of Depreciation Apply:

- Financial Reporting Systems: GAAP in the U.S., IFRS internationally.

- Tax Authorities: IRS in the U.S., HMRC in the UK, CRA in Canada, and other national tax bodies.

- Industry-Specific Regulations: Oil & gas, mining, utilities, and other industries with specialized requirements.

- Public Sector and Governmental Entities: Following GASB in the U.S. or IPSAS internationally.

- Corporate Internal Policies: Multinational companies with internal compliance measures.

- Auditing and Regulatory Compliance: SEC and auditors ensure appropriate application of depreciation.

Each of these contexts defines where specific depreciation methods must be followed, ensuring consistency and regulatory compliance across various regions and sectors.

How is Required Methods of depreciation

The required methods of depreciation are implemented through specific steps and processes, ensuring compliance with accounting standards, tax regulations, and industry guidelines. The process involves selecting, calculating, and applying the chosen depreciation method consistently across financial reporting periods, tax filings, and regulatory audits.

How Required Methods of Depreciation Are Implemented:

1. Selection of Depreciation Method

When a company acquires a new asset, it must determine the appropriate depreciation method. This selection process is governed by:

- Accounting Standards (GAAP, IFRS):

- Companies must select a depreciation method that reflects the pattern of how the asset’s economic benefits are consumed over time.

- Common methods include:

- Straight-line depreciation (even allocation of cost over the asset’s useful life)

- Declining balance depreciation (accelerated depreciation, higher expense in earlier years)

- Units of production depreciation (based on usage, such as machine hours or production volume)

- Tax Regulations:

- The tax authority (e.g., IRS in the U.S.) mandates which method a company must use for tax purposes. In the U.S., the IRS requires the Modified Accelerated Cost Recovery System (MACRS) for most assets.

- For international companies, local tax authorities may require different methods (e.g., Capital Cost Allowance (CCA) in Canada or pool depreciation methods in other regions).

- Industry-Specific Requirements:

- Some industries (e.g., oil and gas, mining) use units of production depreciation, where asset value is tied to resource extraction rates or production levels.

2. Calculation of Depreciation

Once the method is selected, companies calculate depreciation for each financial period. The formula varies depending on the method:

- Straight-Line Depreciation Formula:

- Depreciation Expense=Cost of Asset−Salvage Value/Useful Life

- Example: If an asset costs $50,000, has a salvage value of $5,000, and a useful life of 10 years, the annual depreciation is:

Annual Depreciation=50,000−5,000/10=4,500

- Declining Balance Depreciation Formula:

- Depreciation Expense=Net Book Value×Depreciation Rate

- This method results in higher depreciation expenses in the early years, as a fixed percentage is applied to the book value.

- MACRS (Tax-Based Depreciation in the U.S.):

- The IRS provides a detailed MACRS table with pre-defined recovery periods and percentages for different asset classes.

- Companies look up the class life for their asset (e.g., 5-year, 7-year property) and apply the appropriate rate from the table.

- Units of Production Formula:

- Depreciation Expense=Cost of Asset−Salvage Value/Total Expected Units×Units Produced in the Period

- Example: A mining machine is expected to extract 100,000 tons over its life, and 10,000 tons were extracted in the current period. Depreciation is calculated based on usage.

3. Recording Depreciation in Financial Statements

Depreciation must be recorded consistently in financial reports as per the chosen method:

- Income Statement:

- Depreciation expense is listed under operating expenses.

- Depreciation reduces net income, but since it is a non-cash expense, it does not affect the company’s cash flow directly.

- Balance Sheet:

- The depreciated asset is shown at net book value (original cost minus accumulated depreciation).

- Cash Flow Statement:

- Depreciation is added back in the cash flow from operations section since it’s a non-cash expense.

4. Compliance with Tax Authorities

For tax filings, companies must follow the required depreciation method mandated by tax authorities. This involves:

- Using the Appropriate Depreciation Schedule:

- Companies in the U.S. must apply MACRS schedules for tax depreciation. The specific rates for each year are applied depending on the asset’s class life and whether it’s personal or real property.

- Filing Tax Returns:

- Depreciation reduces taxable income, so companies include it in their annual tax filings as part of deductible expenses. Failing to comply with required methods could result in penalties or adjustments by tax authorities.

5. Monitoring and Adjusting Depreciation

- Impairment of Assets:

- If an asset’s value significantly decreases due to unforeseen events, companies may need to assess the asset for impairment and adjust the depreciation method or value accordingly, in line with accounting standards.

- Change in Useful Life or Salvage Value:

- If there is a change in the expected useful life or salvage value of an asset, the depreciation schedule may need to be revised. For example, under IFRS, businesses may adjust depreciation mid-life to reflect updated estimates.

- Component Depreciation (IFRS):

- Under IFRS, if different components of an asset have different useful lives, companies must depreciate each component separately. For instance, a building’s roof may have a shorter life than the structure, requiring separate depreciation schedules.

6. Auditing and Regulatory Oversight

- Auditors’ Role:

- During financial audits, auditors verify that companies are applying the required depreciation methods correctly. Auditors ensure compliance with GAAP, IFRS, or other accounting frameworks, and confirm that depreciation is calculated in a way that aligns with the company’s policies and external regulations.

- Regulatory Bodies (e.g., SEC):

- For publicly traded companies, regulators like the Securities and Exchange Commission (SEC) require proper disclosure of depreciation methods in financial statements. Non-compliance can result in fines, restatements, or penalties.

7. Documentation and Reporting

- Disclosures in Financial Reports:

- Companies are required to disclose the depreciation methods they use in the notes to the financial statements. This includes:

- The method applied (e.g., straight-line, MACRS).

- The estimated useful life of each major class of depreciable asset.

- Any changes to depreciation estimates or methods during the reporting period.

- Companies are required to disclose the depreciation methods they use in the notes to the financial statements. This includes:

Summary of How Required Methods of Depreciation Are Implemented:

- Selection: The appropriate method is chosen based on accounting standards, tax laws, or industry requirements.

- Calculation: The method is applied to calculate depreciation expenses each period using the relevant formula.

- Recording: Depreciation is recorded in the income statement, balance sheet, and cash flow statement.

- Compliance: Businesses ensure compliance with tax authorities’ specific requirements (e.g., MACRS in the U.S.).

- Adjustments: Depreciation methods or schedules may be adjusted due to asset impairment or changes in useful life.

- Auditing: Depreciation methods are subject to audit and regulatory oversight.

- Documentation: Companies disclose their depreciation policies and any changes in their financial reports.

These steps ensure that the depreciation method used is compliant with legal, tax, and accounting standards, and that it reflects the true economic value of assets over time.

Case Study on Methods of depreciation

Depreciation Methods at XYZ Manufacturing Company

Overview:

XYZ Manufacturing Company is a mid-sized producer of industrial machinery. The company owns a variety of fixed assets, including machinery, buildings, office equipment, and vehicles. To comply with financial reporting requirements (IFRS) and local tax regulations (IRS for U.S. operations), XYZ must choose appropriate depreciation methods for different assets.

XYZ Manufacturing uses three main depreciation methods:

- Straight-line Depreciation for buildings and office equipment.

- Double-declining Balance Depreciation for machinery.

- Units of Production Depreciation for specialized equipment in production lines.

Scenario:

In 2020, XYZ Manufacturing purchased the following assets:

- New Manufacturing Machinery: Cost $500,000, expected useful life of 10 years, with no salvage value.

- Office Building: Cost $1,200,000, expected useful life of 40 years, with a salvage value of $200,000.

- Company Vehicles: Cost $100,000, expected useful life of 5 years, with a salvage value of $20,000.

- Production Equipment: Cost $600,000, expected to produce 200,000 units over its useful life, with a salvage value of $50,000.

Depreciation Method Selection:

- Machinery (Double-declining Balance Depreciation):

- Since the machinery is expected to lose value rapidly in the early years due to heavy usage, XYZ chose the double-declining balance method for its accelerated depreciation. This allows the company to match depreciation expenses with higher revenues in the machinery’s early operational years.

- Office Building (Straight-line Depreciation):

- For the office building, XYZ chose the straight-line depreciation method to evenly spread the cost over its useful life, reflecting gradual wear and tear.

- Company Vehicles (Straight-line Depreciation):

- Vehicles were also depreciated using the straight-line method, as their value decreases steadily over time, and this method simplifies calculations for fleet management.

- Production Equipment (Units of Production Depreciation):

- The company selected units of production depreciation for the specialized equipment. This method ties depreciation to actual usage (number of units produced), ensuring depreciation costs align with production output.

Depreciation Calculations:

1. Machinery (Double-declining Balance Method):

- Formula:Depreciation Expense=Beginning Book Value×(2/Useful Life)

- Year 1 Depreciation:Depreciation=500,000×(2/10)=100,000

- Book value at the end of Year 1 = $500,000 – $100,000 = $400,000.

- Year 2 Depreciation:Depreciation=400,000×(2/10)=80,000

- Book value at the end of Year 2 = $400,000 – $80,000 = $320,000.

2. Office Building (Straight-line Depreciation):

- Formula: Annual Depreciation=Cost−Salvage Value/Useful Life

Depreciation=1,200,000−200,000/40=25,000 per year.- Book value at the end of Year 1 = $1,200,000 – $25,000 = $1,175,000.

3. Company Vehicles (Straight-line Depreciation):

Depreciation=100,000−20,000/5=16,000 per year.

- Book value at the end of Year 1 = $100,000 – $16,000 = $84,000.

4. Production Equipment (Units of Production Method):

- Expected total units = 200,000 units

- Year 1 production = 40,000 units

- Formula:Depreciation Expense=Cost−Salvage Value/Total Expected Units×Units Produced in Year

Depreciation=600,000−50,000/200,000×40,000=110,000- Book value at the end of Year 1 = $600,000 – $110,000 = $490,000.

Analysis:

Financial Reporting (IFRS Compliance):

- XYZ Manufacturing prepares its financial statements in accordance with IFRS, which allows flexibility in choosing depreciation methods that reflect the consumption of asset value.

- The straight-line method for the building and vehicles provides a clear, consistent expense across reporting periods.

- The double-declining balance method for machinery reflects the rapid wear of machinery in its early years, aligning depreciation with the expected decline in utility.

- The units of production method for production equipment ensures that depreciation aligns with actual usage, providing a more accurate reflection of the asset’s wear and tear during production.

Tax Reporting (IRS Compliance):

- For U.S. tax purposes, XYZ Manufacturing must use the MACRS (Modified Accelerated Cost Recovery System) method for machinery, vehicles, and equipment. This method allows accelerated depreciation, offering tax benefits by reducing taxable income in the early years.

- XYZ aligns its tax depreciation with MACRS schedules but uses IFRS-compliant methods for financial reporting. This results in deferred tax liabilities, as financial and tax depreciation differ.

Impact on Financial Statements:

- Income Statement:

- Depreciation expenses for machinery are higher in the first few years due to the double-declining method, reducing net income.

- Production equipment depreciation will fluctuate based on output, aligning expenses with revenue generation.

- Balance Sheet:

- The net book value of machinery declines rapidly due to accelerated depreciation, while the building’s value declines steadily.

- Cash Flow:

- Since depreciation is a non-cash expense, it is added back in the operating activities section of the cash flow statement, improving cash flow despite lower net income.

Conclusion:

XYZ Manufacturing’s use of different depreciation methods demonstrates how businesses can align their depreciation approach with financial reporting standards (IFRS), tax regulations (IRS), and operational realities. By using multiple methods, XYZ can optimize tax benefits, present a true financial picture to investors, and accurately match depreciation expenses to asset usage. This ensures that financial statements reflect the economic reality of asset consumption, while tax strategies help manage cash flow and reduce taxable income.

Lessons Learned:

- Method Selection Based on Asset Type: Choosing the correct method for each asset ensures financial accuracy.

- Compliance with Standards: Adherence to IFRS for financial reporting and MACRS for tax compliance shows how companies can balance dual reporting requirements.

- Impact on Financial Performance: Depreciation methods significantly impact reported income, taxes, and asset values.

- Flexibility with IFRS: IFRS provides flexibility in choosing depreciation methods, allowing companies to align asset value with economic benefit.

White paper on Methods of depreciation

Introduction

Depreciation is a fundamental accounting concept that allows businesses to allocate the cost of tangible fixed assets over their useful lives. It reflects the gradual reduction in an asset’s value due to wear and tear, usage, obsolescence, or aging. Depreciation is not only a regulatory requirement under various accounting standards (e.g., IFRS, GAAP) but also essential for accurate financial reporting and tax calculation. This white paper explores the different methods of depreciation, their applicability, and their impact on financial statements and taxation.

Purpose of Depreciation

The primary goal of depreciation is to match the cost of a fixed asset with the revenue it generates over time. Depreciation ensures that the expense associated with using the asset is recognized in the same period that the asset contributes to revenue generation. This approach aligns with the matching principle in accounting.

Key Purposes of Depreciation:

- Accurate financial reporting: Provides a realistic reflection of asset value over time.

- Compliance with accounting standards: Ensures companies adhere to IFRS, GAAP, or other local standards.

- Tax optimization: Accelerated depreciation methods can reduce taxable income in the short term, providing cash flow benefits.

Types of Depreciation Methods

1. Straight-Line Depreciation

The straight-line method is the simplest and most commonly used form of depreciation. It allocates an equal portion of the asset’s cost to each year of its useful life.

Formula:

Annual Depreciation=Cost of Asset−Salvage Value/Useful Life

Example:

An office building is purchased for $500,000, with a salvage value of $50,000 and a useful life of 40 years.Annual Depreciation=500,000−50,000/40=11,250

When to Use:

- For assets that have a consistent rate of wear and tear, such as buildings or office furniture.

- When a simple, predictable depreciation expense is preferred.

Advantages:

- Easy to calculate and understand.

- Results in steady depreciation expenses over time.

Disadvantages:

- Does not account for the possibility that some assets lose value faster in the initial years of use.

2. Double-Declining Balance Depreciation

The double-declining balance method is an accelerated depreciation method that recognizes more depreciation in the early years of an asset’s life. This method is appropriate for assets that experience higher usage or obsolescence early in their life cycle.

Formula:

Depreciation=Book Value at Beginning of Year×2/Useful Life

Example:

For a machine with a purchase cost of $100,000 and a useful life of 10 years:

- Year 1 Depreciation:

100,000×(2/10)=20,000

- Year 2 Depreciation (on the reduced book value):

80,000×(2/10)=16,000

When to Use:

- For assets that experience rapid decline in utility or value, such as technology equipment, vehicles, or heavy machinery.

Advantages:

- Matches higher depreciation expenses with greater revenue generation in the early years of an asset’s use.

Disadvantages:

- Results in lower depreciation expenses in later years, potentially misaligning costs with asset usage.

3. Sum-of-the-Years’-Digits Depreciation

This is another accelerated depreciation method that applies higher depreciation in the earlier years. The sum-of-the-years’ digits (SYD) method calculates depreciation based on a declining fraction.

Formula:

Depreciation=Remaining Life of Asset/Sum of Years’ Digits×(Cost of Asset−Salvage Value)

Example:

For an asset with a cost of $10,000, a salvage value of $2,000, and a useful life of 5 years:

- Sum of years’ digits = 1+2+3+4+5 = 15

- Year 1 Depreciation:

5/15×(10,000−2,000)=2,666.67

When to Use:

- When asset utility declines sharply in the early years, similar to double-declining balance.

Advantages:

- Allows for a more gradual reduction in depreciation compared to the double-declining balance method.

Disadvantages:

- Complex calculation.

- Like other accelerated methods, may not align well with assets that experience consistent wear.

4. Units of Production Depreciation

The units of production method ties depreciation directly to the asset’s usage or output rather than the passage of time. It is based on the total expected units an asset can produce over its useful life.

Formula:

Depreciation Expense=(Cost – Salvage Value)/Total Estimated Units×Units Produced in Year

Example:

For a machine costing $50,000, expected to produce 100,000 units with no salvage value, and producing 10,000 units in the first year:50,000/100,000×10,000=5,000

When to Use:

- For assets whose wear and tear are tied to production levels, such as manufacturing equipment.

Advantages:

- Accurately matches depreciation expense with asset usage.

Disadvantages:

- Can lead to volatile depreciation expenses depending on production levels.

5. MACRS (Modified Accelerated Cost Recovery System)

Used primarily for tax purposes in the United States, MACRS is a government-mandated depreciation method that uses a fixed depreciation rate over an asset’s class life. It is a combination of the declining balance method with a switch to the straight-line method in later years.

When to Use:

- Mandatory for U.S. tax filings, MACRS allows for accelerated depreciation, offering early tax benefits to businesses.

Advantages:

- Tax benefits are higher in the early years due to accelerated depreciation.

Disadvantages:

- Not used for financial reporting under IFRS or GAAP; businesses must maintain separate depreciation schedules for tax and financial reporting.

Factors Influencing the Choice of Depreciation Method

1. Asset Type and Usage:

Different assets have varying rates of wear and tear. Machinery and equipment that degrade quickly may require accelerated methods, while buildings may be better suited for straight-line depreciation.

2. Matching Costs to Revenue:

Depreciation should reflect how the asset contributes to revenue. Accelerated methods work best for assets that are more productive in their early years.

3. Regulatory Compliance:

Businesses must ensure their chosen method complies with the relevant accounting standards, such as IFRS, GAAP, or tax laws.

4. Tax Strategy:

Certain methods, such as MACRS in the U.S., offer tax advantages by front-loading depreciation expenses.

5. Financial Reporting Objectives:

Companies seeking to present steady profits may prefer the straight-line method, while those aiming to maximize early tax benefits may prefer accelerated methods.

Impact of Depreciation on Financial Statements

- Income Statement: Depreciation is recorded as an operating expense, directly reducing net income.

- Balance Sheet: Depreciation reduces the book value of assets over time. Accumulated depreciation is reported as a contra-asset account.

- Cash Flow Statement: Since depreciation is a non-cash expense, it is added back in the operating activities section, affecting cash flow without reducing cash balances.

Conclusion

Depreciation plays a crucial role in ensuring that asset costs are properly allocated over time. The choice of depreciation method impacts financial reporting, tax liabilities, and business decision-making. Straight-line depreciation is best for assets with consistent utility, while accelerated methods (like double-declining balance) are suitable for assets that depreciate quickly. Units of production provides a usage-based approach, and MACRS is essential for tax purposes. Understanding and selecting the appropriate depreciation method can lead to more accurate financial statements and better financial planning.

Industrial Application of Methods of depreciation

Depreciation methods play a critical role across various industries by helping businesses manage their assets efficiently, control costs, and align financial reporting with asset usage. Different depreciation methods cater to the specific needs of industries based on asset types, usage patterns, and tax strategies. Below are industrial applications of various methods of depreciation:

1. Manufacturing Industry

The manufacturing sector often deals with heavy machinery, equipment, and tools that experience significant wear and tear due to high operational usage. Here, depreciation methods are chosen based on the nature and intensity of asset usage.

Common Depreciation Method: Units of Production

- Application: Depreciation is tied to machine output (units produced), making it ideal for assets that wear down with usage.

- Example: A car manufacturing plant may use the units of production method for assembly-line machines, where depreciation is calculated based on the number of vehicles produced. This ensures the machine’s cost is spread proportionally to its usage, reflecting its contribution to production.

Alternative Method: Double-Declining Balance

- Application: Machines with high upfront usage but diminishing productivity over time.

- Example: CNC machines or heavy-duty stamping presses that lose efficiency after the first few years of operation can use the double-declining balance method to record higher depreciation in early years when wear and tear are most significant.

2. Construction Industry

Construction companies invest in expensive, durable equipment such as cranes, bulldozers, and excavators. These assets have long but varying lifespans, depending on how frequently they are used in projects.

Common Depreciation Method: MACRS (Modified Accelerated Cost Recovery System)

- Application: For U.S. companies, the MACRS system is often employed for tax purposes, allowing businesses to accelerate depreciation for construction machinery and vehicles in the early years.

- Example: A construction firm purchasing a $500,000 crane can use MACRS to reduce taxable income by front-loading depreciation in the first few years of the asset’s useful life, providing cash flow relief during capital-intensive projects.

Alternative Method: Straight-Line Depreciation

- Application: For long-lived assets like buildings or infrastructure where wear and tear occur gradually.

- Example: Depreciation of a commercial building over 30 years using the straight-line method ensures steady, predictable expenses.

3. Technology and IT Industry

In the technology industry, equipment like servers, computers, and network infrastructure becomes obsolete quickly due to rapid technological advancements.

Common Depreciation Method: Double-Declining Balance

- Application: Accelerated depreciation is critical for technology assets, which lose value quickly due to obsolescence.

- Example: An IT company purchasing a server for $100,000 can use the double-declining balance method, recording higher depreciation expenses in the first few years as the equipment becomes outdated, allowing the company to write off the asset before it becomes obsolete.

Alternative Method: Straight-Line Depreciation

- Application: For software licenses or patents with a known useful life and consistent utility.

- Example: A company developing proprietary software with a 5-year lifespan may apply straight-line depreciation for the software development costs.

4. Transportation and Logistics Industry

Transportation companies heavily rely on vehicles, planes, ships, and other mobile assets. Depreciation in this industry is crucial for managing large fleets and predicting replacement cycles.

Common Depreciation Method: Sum-of-the-Years’-Digits

- Application: For vehicles and fleets that experience significant depreciation in the early years.

- Example: A logistics company purchasing delivery trucks can use the sum-of-the-years’-digits method, where most depreciation occurs in the first few years of use when maintenance costs are lower, but asset value declines quickly.

Alternative Method: Units of Production

- Application: For transportation assets that depreciate based on mileage or hours of use.

- Example: Airlines often use units of production (based on flight hours) for aircraft depreciation, aligning costs with the actual use of the plane.

5. Retail Industry

In the retail sector, businesses must manage a range of physical assets, from store fixtures and equipment to real estate and IT systems, which need accurate depreciation for financial reporting and tax optimization.

Common Depreciation Method: Straight-Line Depreciation

- Application: Retail chains typically use straight-line depreciation for store fixtures, furniture, and leasehold improvements, which deteriorate steadily over time.

- Example: A clothing retailer may use the straight-line method to depreciate store shelving, point-of-sale (POS) systems, and lighting over a 10-year period.

Alternative Method: Double-Declining Balance

- Application: For IT systems or equipment that becomes obsolete rapidly.

- Example: Retailers investing in security systems or digital POS systems may use double-declining balance for faster depreciation to match the system’s limited operational life before technological upgrades are required.

6. Healthcare Industry

Hospitals and medical facilities rely on expensive medical equipment, which depreciates differently based on technology, usage, and maintenance costs.

Common Depreciation Method: Units of Production

- Application: For equipment such as MRI machines, X-rays, and lab equipment, where depreciation can be tied to the number of scans or tests performed.

- Example: A hospital may apply units of production to an MRI machine that performs a specific number of scans annually, spreading the cost over the total expected number of tests.

Alternative Method: Straight-Line Depreciation

- Application: For infrastructure such as hospital buildings, furniture, and general medical equipment with predictable wear and tear.

- Example: Hospitals often use the straight-line method for depreciating patient beds, wheelchairs, and other non-specialized equipment.

7. Energy and Utilities Industry

The energy sector, particularly companies involved in oil, gas, and electricity, use high-value, long-term assets like power plants, pipelines, and drilling equipment that depreciate over decades.

Common Depreciation Method: Straight-Line Depreciation

- Application: For assets with long lives and stable usage, such as power plants, dams, and pipelines.

- Example: A utility company building a $1 billion power plant with a 40-year life may use straight-line depreciation to spread the cost evenly across the asset’s useful life.

Alternative Method: MACRS

- Application: For U.S. tax purposes, the MACRS system allows companies to accelerate depreciation for oil drilling rigs, trucks, and other high-cost assets, reducing taxable income in the early years.

- Example: An oil company may apply MACRS to depreciate drilling equipment, taking advantage of higher deductions in the initial years of use.

8. Real Estate and Property Management

Real estate companies that manage rental properties and commercial buildings often deal with long-lived assets requiring appropriate depreciation schedules for accurate financial management and tax planning.

Common Depreciation Method: Straight-Line Depreciation

- Application: For buildings and improvements that have a stable and predictable lifespan.

- Example: A commercial real estate company may use straight-line depreciation to depreciate office buildings and apartment complexes over a 30-40 year period.

Alternative Method: Double-Declining Balance

- Application: For equipment or fixtures that may need frequent updating, such as HVAC systems or elevators.

- Example: A property management firm may use the double-declining balance method to depreciate HVAC systems, ensuring higher depreciation when they are more likely to need repairs or replacement.

Conclusion

Depreciation methods vary widely across industries based on the nature of assets and the objectives of the business, whether for accurate financial reporting or tax optimization. Industries with rapidly aging assets, such as technology and transportation, benefit from accelerated depreciation methods like double-declining balance and sum-of-the-years’-digits. Meanwhile, sectors with long-term assets, like real estate and energy, often use straight-line depreciation to spread costs evenly. The careful selection of depreciation methods is crucial for aligning expenses with asset usage and achieving financial and tax-related goals.