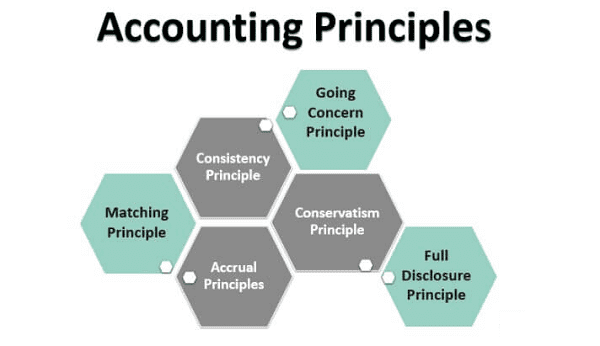

PRINCIPLES OF ACCOUNTING- Principles of Accounting refer to the fundamental concepts and guidelines that govern the field of accounting. These principles provide a framework for recording, reporting, and analyzing financial transactions of businesses and organizations. While there are several principles, the core ones include:

- The Entity Concept: This principle assumes that a business or organization is a separate economic entity distinct from its owners or other businesses. As a result, the personal transactions of the owner should be kept separate from the business transactions.

- The Money Measurement Concept: It states that financial transactions should be recorded and reported in a common monetary unit (e.g., the currency of the country where the business operates), ensuring consistency and comparability in financial statements.

- The Going Concern Concept: This principle assumes that a business will continue to operate indefinitely unless there is evidence to the contrary. Therefore, assets are recorded at their historical cost, and depreciation is spread over their expected useful lives.

- The Cost Principle (Historical Cost): Under this principle, assets and liabilities should be initially recorded at their historical cost, which is the original purchase price or acquisition cost. Subsequent adjustments may be made for depreciation, impairment, or other factors, but the historical cost is the basis for initial recognition.

- The Dual Aspect (Double Entry) Concept: This fundamental accounting equation states that Assets = Liabilities + Owner’s Equity. Every financial transaction has two sides – a debit and a credit – which must balance to maintain this equation. This ensures that the accounting equation is always in balance.

- The Matching Principle: Expenses should be recognized in the income statement in the same period as the revenue they help generate. This principle is also known as the accrual accounting concept, as it focuses on recognizing revenue and expenses when they are incurred, not necessarily when cash changes hands.

- The Revenue Recognition Principle: Revenue should be recognized when it is earned and realizable, regardless of when cash is received. This principle helps ensure that financial statements accurately reflect a company’s performance.

- The Consistency Principle: Accounting methods and principles should be applied consistently from one period to another, allowing for meaningful comparisons between different accounting periods.

- The Materiality Principle: Accountants should focus on reporting material information that can impact the decisions of users of financial statements. Immaterial items can be disregarded or aggregated.

- The Conservatism Principle: When faced with uncertainty, accountants should err on the side of caution. This means that anticipated losses should be recognized immediately, while anticipated gains should only be recognized when realized.

- The Full Disclosure Principle: Financial statements should include all necessary information to ensure users have a complete understanding of a company’s financial position and performance. This includes footnotes, supplementary schedules, and other disclosures.

These principles collectively form the basis for the Generally Accepted Accounting Principles (GAAP) in the United States, and they guide the preparation and presentation of financial statements, making them more reliable, consistent, and useful for decision-making by investors, creditors, and other stakeholders. However, it’s essential to note that accounting standards and principles may vary from one country to another, and different industries may have their own specific guidelines and regulations.

What is PRINCIPLES OF ACCOUNTING

“Principles of Accounting” generally refers to the fundamental concepts and guidelines that govern the practice of accounting. These principles provide a framework for recording, summarizing, and reporting financial transactions and information. They ensure consistency, accuracy, and transparency in financial reporting. While the specific principles may vary by accounting standard-setting bodies and jurisdictions, the core principles typically include:

- Accrual Basis: Accounting should be done using the accrual basis, which means recognizing revenues when they are earned and expenses when they are incurred, regardless of when the cash changes hands. This principle aims to match revenue and expenses accurately.

- Conservatism: When faced with uncertainty or ambiguity, accountants should exercise caution and conservatism. This principle encourages recognizing potential losses as soon as they are probable while delaying the recognition of potential gains until they are realized.

- Consistency: Accounting methods and principles should be applied consistently from one accounting period to another. This consistency allows for meaningful comparisons over time.

- Materiality: Financial statements should disclose all information that could influence the decisions of users. However, immaterial items can be disregarded or aggregated to avoid unnecessary complexity.

- Historical Cost: Assets are typically recorded at their historical cost, which is the original purchase price. While some exceptions exist, this principle provides objectivity and reliability in financial reporting.

- Going Concern: Financial statements are prepared with the assumption that the entity will continue to operate indefinitely. This principle impacts the treatment of assets and liabilities.

- Entity Concept: The financial affairs of the business entity are separate from the personal affairs of its owners. This separation ensures that business transactions are recorded independently.

- Full Disclosure: All significant information relevant to understanding the financial statements should be disclosed. This includes not only the main financial statements but also supplementary notes and explanations.

- Revenue Recognition: Revenue is recognized when it is earned and realizable, not necessarily when cash is received. This principle is essential for accurately portraying an entity’s financial performance.

- Matching Principle: Expenses should be recognized in the same period as the revenue they help generate. This principle helps in accurately determining the net income for a specific accounting period.

These principles, among others, collectively form the foundation of Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) used in many other countries. Following these principles ensures that financial statements are prepared in a consistent and standardized manner, making it easier for investors, creditors, and other stakeholders to analyze and compare financial information across different entities and periods.

Who is Required PRINCIPLES OF ACCOUNTING

The principles of accounting are not required by a specific individual but rather by the accounting profession and regulatory bodies. These principles serve as a framework for how financial accounting and reporting should be conducted. They are intended to ensure that financial statements are prepared consistently, accurately, and transparently, which is essential for the benefit of various stakeholders, including investors, creditors, regulators, and the general public.

The key entities and groups that require and enforce the principles of accounting include:

- Accounting Standard-Setting Bodies: These organizations, such as the Financial Accounting Standards Board (FASB) in the United States and the International Accounting Standards Board (IASB) globally, are responsible for developing and promulgating accounting standards and principles. They play a crucial role in establishing and updating the principles that govern financial reporting.

- Regulatory Authorities: Government regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC) in the United States, oversee financial reporting for publicly traded companies. They often mandate the use of specific accounting standards, such as Generally Accepted Accounting Principles (GAAP) in the U.S.

- Professional Accounting Associations: Accounting associations like the American Institute of Certified Public Accountants (AICPA) and the Association of Chartered Certified Accountants (ACCA) play a role in promoting and upholding ethical and professional standards among their members. They may also provide guidance on best practices that align with accounting principles.

- Certified Public Accountants (CPAs) and Chartered Accountants (CAs): Accounting professionals, including CPAs and CAs, are responsible for applying accounting principles when preparing financial statements and reports for their clients or employers. They are required to adhere to these principles to ensure the accuracy and integrity of financial information.

- Businesses and Organizations: Companies, whether publicly traded or privately owned, are required to follow accounting principles when preparing their financial statements. This ensures that their financial reports provide an accurate representation of their financial position and performance.

- Investors and Creditors: Investors and creditors rely on financial statements to make informed decisions about allocating their resources. They require that companies follow accounting principles to provide consistent and reliable financial information.

- Auditors: Independent auditors, who review and verify financial statements, use accounting principles as the basis for their audits. They assess whether a company’s financial statements comply with these principles and provide a true and fair view of the company’s financial position.

In summary, the principles of accounting are required and enforced by various entities and stakeholders within the accounting profession and the broader business and financial community. Adherence to these principles is essential to maintain the integrity and reliability of financial reporting.

When is Required PRINCIPLES OF ACCOUNTING

The principles of accounting are required to be followed consistently in the following situations:

- Financial Reporting: Principles of accounting are most commonly required when preparing financial statements. This includes the income statement, balance sheet, statement of cash flows, and accompanying notes. Companies, whether publicly traded or privately owned, must adhere to accounting principles to ensure the accuracy and reliability of these financial reports.

- Audit and Assurance Services: When a company undergoes an external audit or engages an independent auditor to review its financial statements, accounting principles are essential. Auditors assess whether the financial statements comply with the relevant accounting principles and standards.

- Tax Reporting: Accounting principles are also necessary for tax reporting. Companies must calculate their taxable income in accordance with the applicable tax laws and regulations, which often require adherence to specific accounting principles.

- Regulatory Compliance: Publicly traded companies are subject to regulatory requirements, such as the rules and regulations of the U.S. Securities and Exchange Commission (SEC) in the United States. These regulations often mandate the use of Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which are sets of accounting principles and standards.

- Loan Agreements and Covenants: When a company borrows money or enters into loan agreements, lenders may require compliance with specific accounting principles as part of the covenants. These principles ensure that the borrower maintains certain financial ratios and performance metrics.

- Investor and Creditor Expectations: Investors, creditors, and other stakeholders expect companies to follow accounting principles when presenting their financial information. This consistency and adherence to established principles enhance the reliability and comparability of financial statements.

- Internal Decision-Making: Even for internal purposes, companies often use accounting principles to prepare management reports and make informed decisions about budgeting, forecasting, and resource allocation.

- Professional Ethics and Standards: Accounting professionals, such as Certified Public Accountants (CPAs) and Chartered Accountants (CAs), are required to follow ethical standards and guidelines in their practice. These ethical standards often include a commitment to adhering to accounting principles to ensure the integrity and accuracy of financial information.

In summary, the application of accounting principles is required whenever financial information is prepared, presented, audited, or used for decision-making, whether for internal or external purposes. Adherence to these principles ensures that financial information is prepared consistently, accurately, and transparently, benefiting both the organizations and the stakeholders who rely on this information.

Where is Required PRINCIPLES OF ACCOUNTING

The principles of accounting are required and applied in various contexts and locations, primarily within the field of financial reporting and accounting. Here are some common places and situations where the principles of accounting are required:

- Businesses and Corporations: All types of businesses, whether they are sole proprietorships, partnerships, corporations, or other entities, are required to follow accounting principles when preparing their financial statements. These principles ensure that the financial statements accurately reflect the company’s financial position and performance.

- Publicly Traded Companies: Publicly traded companies, listed on stock exchanges, are often subject to strict regulatory requirements regarding financial reporting. They must adhere to specific accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) in the United States or International Financial Reporting Standards (IFRS) in many other countries.

- Government Entities: Government agencies, at various levels (federal, state, and local), are required to follow accounting principles and standards when preparing their financial reports. These reports are essential for transparency and accountability in the use of public funds.

- Nonprofit Organizations: Nonprofit organizations, including charities, foundations, and educational institutions, are also required to follow accounting principles. They may have specific accounting standards tailored to their unique reporting needs, such as the Financial Accounting Standards Board (FASB) standards for nonprofit organizations in the United States.

- Individuals and Personal Finance: While individuals may not be subject to formal accounting principles in the same way that businesses are, many people apply basic accounting principles in managing their personal finances. They track income, expenses, and assets to maintain control over their financial well-being.

- Auditing and Assurance Services: Independent auditors and audit firms are required to apply accounting principles when reviewing and auditing financial statements. They assess whether the financial statements are prepared in accordance with relevant accounting standards and principles.

- Taxation: Tax authorities require individuals and businesses to adhere to specific accounting principles when calculating taxable income and reporting financial information for tax purposes. Tax regulations often have their own set of rules and principles.

- Loan Agreements and Contracts: Lenders and creditors may require businesses to follow specific accounting principles and maintain certain financial ratios and covenants as part of loan agreements and contracts.

- International Business Transactions: Companies engaged in international business must often reconcile financial reporting between different countries and regions, following international accounting principles to ensure consistency and compliance with local regulations.

- Educational Institutions: Accounting principles are taught and required in academic settings, such as colleges and universities, where accounting students learn and apply these principles to solve real-world financial problems.

In summary, the principles of accounting are required and applied in a wide range of settings, from businesses and government entities to personal finance management and educational institutions. The specific accounting principles and standards may vary depending on the nature of the entity, its location, and the regulatory framework it operates under. Adhering to these principles is crucial for maintaining accurate and reliable financial reporting and decision-making.

How is Required PRINCIPLES OF ACCOUNTING

It appears you’re asking about how accounting principles are applied or implemented in practice. Accounting principles are applied in the field of accounting through a systematic process of recording, summarizing, and reporting financial transactions. Here’s how these principles are typically put into action:

- Recording Transactions: When a financial transaction occurs, accountants record it using the double-entry accounting system. This involves making two entries for every transaction—a debit entry and a credit entry—following the principles of the accounting equation (Assets = Liabilities + Equity). The choice of accounts to debit and credit depends on the nature of the transaction and the accounting principles being applied.

- Classification and Categorization: Transactions are classified into various accounts based on their nature (e.g., cash, accounts receivable, inventory, etc.). These accounts are organized into the general ledger, which is a comprehensive record of all financial transactions.

- Accrual Accounting: Most accounting principles, such as revenue recognition and matching, are based on accrual accounting. Under this method, revenues and expenses are recognized when they are earned or incurred, not necessarily when cash changes hands. This ensures that financial statements reflect the economic reality of the transactions.

- Financial Statements: Accountants use the recorded transactions to prepare financial statements, including the income statement (profit and loss statement), balance sheet, and statement of cash flows. These statements provide a clear picture of a company’s financial performance and position.

- Application of GAAP or IFRS: Depending on the jurisdiction and the reporting requirements, accountants apply the relevant Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards provide specific guidelines and rules that must be followed when preparing financial statements.

- Auditing and Assurance: Independent auditors review a company’s financial statements to ensure compliance with accounting principles and standards. They provide an opinion on the fairness and accuracy of the financial statements.

- Internal Controls: Companies implement internal controls to ensure that transactions are recorded accurately and in compliance with accounting principles. This includes processes for authorizing transactions, reconciling accounts, and preventing fraud.

- Financial Analysis and Decision-Making: Stakeholders, such as investors, creditors, and management, use the financial statements prepared based on accounting principles to make informed decisions. They analyze financial ratios and trends to assess a company’s financial health and performance.

- Continuous Updates: Accounting principles are not static; they may evolve over time due to changes in business practices and regulations. Accountants must stay informed about updates and changes to ensure compliance.

- Ethical Considerations: Accountants must adhere to ethical standards and professional codes of conduct while applying accounting principles. This includes principles like objectivity, integrity, and confidentiality.

In summary, accounting principles are applied through a structured process that involves recording transactions, classifying them, preparing financial statements, following specific guidelines (GAAP or IFRS), and ensuring compliance with ethical standards and internal controls. This process helps ensure that financial information is accurate, reliable, and useful for decision-making.

Case Study on PRINCIPLES OF ACCOUNTING

ABC Corporation – Application of Accounting Principles

Background: ABC Corporation is a manufacturing company that produces and sells electronic devices. The company follows Generally Accepted Accounting Principles (GAAP) in the United States for its financial reporting.

Scenario: At the end of the fiscal year, ABC Corporation is preparing its financial statements. The company has various financial transactions and events that need to be recorded and reported in accordance with accounting principles.

Application of Accounting Principles:

- Revenue Recognition:

- ABC Corporation sold electronic devices worth $500,000 during the year. According to the revenue recognition principle, revenue should be recognized when it is earned and realizable. Therefore, the company recognizes $500,000 in revenue on its income statement.

- Matching Principle:

- The company incurred $300,000 in manufacturing costs during the year. These costs are matched with the corresponding revenue, resulting in a gross profit of $200,000 ($500,000 – $300,000).

- Historical Cost Principle:

- ABC Corporation purchased machinery for its manufacturing process for $50,000. The machinery is recorded on the balance sheet at its historical cost. Depreciation is calculated annually to allocate the cost over its useful life.

- Entity Concept:

- The personal expenses of the company’s owners are kept separate from the business expenses. Personal expenses, such as the owner’s salary, are not recorded as business expenses.

- Consistency Principle:

- ABC Corporation has consistently used the straight-line method to calculate depreciation for its assets, ensuring consistency in accounting treatments from year to year.

- Full Disclosure Principle:

- In the footnotes of its financial statements, ABC Corporation provides additional information about its accounting policies, such as depreciation methods, and any significant contingencies or commitments.

- Materiality Principle:

- The company determines that a minor error in accounting for office supplies, valued at $1,000, is immaterial and does not require an adjustment in the financial statements.

- Going Concern Principle:

- The company’s financial statements are prepared under the assumption that ABC Corporation will continue to operate in the foreseeable future.

- Ethical Considerations:

- The company’s accountants adhere to ethical standards and professional codes of conduct, ensuring integrity and objectivity in financial reporting.

- Audit and Assurance:

- An independent auditor reviews ABC Corporation’s financial statements to ensure compliance with accounting principles and provides an opinion on the fairness and accuracy of the financial statements.

Conclusion: ABC Corporation successfully applies accounting principles to prepare its financial statements, which provide a clear and accurate representation of the company’s financial position and performance. The application of these principles ensures transparency, consistency, and reliability in financial reporting, benefiting both the company and its stakeholders.

This case study demonstrates how accounting principles guide the recording, reporting, and disclosure of financial information in a real-world business setting. It also emphasizes the importance of ethical considerations and independent auditing to maintain the credibility of financial statements.

White paper on PRINCIPLES OF ACCOUNTING

A Comprehensive Guide

Abstract:

- A brief summary of the content and importance of the white paper.

Table of Contents:

- Introduction:

- Overview of the importance of accounting principles.

- Purpose and scope of the white paper.

- Historical Development:

- A historical perspective on the evolution of accounting principles.

- The transition from single-entry bookkeeping to double-entry accounting.

- Key Accounting Principles:

- In-depth explanations of fundamental principles, including accrual accounting, revenue recognition, matching, historical cost, and others.

- Accounting Standards and Frameworks:

- Discussion of major accounting standards-setting bodies (e.g., FASB, IASB).

- Overview of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- The Accounting Cycle:

- A step-by-step guide to the accounting cycle, from recording transactions to financial statement preparation.

- Financial Statements:

- Explanation of the components of financial statements (income statement, balance sheet, statement of cash flows, and statement of changes in equity).

- How accounting principles guide the presentation and disclosure of information in financial statements.

- Ethical Considerations in Accounting:

- The importance of ethics in accounting.

- Discussion of ethical principles and codes of conduct for accountants.

- Practical Applications:

- Real-world examples of how accounting principles are applied in various industries and sectors.

- Challenges and Controversies:

- An overview of common challenges and controversies in accounting (e.g., fair value accounting, lease accounting changes).

- How these issues are addressed by accounting standard-setting bodies.

- Auditing and Assurance:

- The role of auditors in ensuring compliance with accounting principles.

- The importance of independent audits in maintaining financial statement reliability.

- Recent Developments:

- A discussion of recent changes and updates to accounting principles (e.g., ASC 606 for revenue recognition, changes in lease accounting).

- The impact of technological advancements on accounting practices.

- Conclusion:

- A summary of key takeaways.

- The enduring significance of accounting principles in financial reporting and decision-making.

- References:

- Citations and sources used in the white paper.

This outline provides a structured approach to creating a comprehensive white paper on the principles of accounting. You can expand each section with detailed information, examples, and analysis to create a thorough and informative document. Additionally, you may want to consult authoritative sources and professional accounting organizations for the most up-to-date information and guidance.