Purpose of Inventory Valuation- Inventory valuation is a crucial accounting process that involves determining the value of a company’s inventory at a given point in time. The purpose of inventory valuation includes:

- Financial Reporting: Accurate inventory valuation is essential for preparing financial statements. It affects the balance sheet (current assets) and income statement (cost of goods sold), influencing profitability and financial ratios.

- Tax Compliance: Inventory valuation impacts taxable income. Different valuation methods can lead to varying tax liabilities, making it important for businesses to adopt a method that aligns with regulatory requirements.

- Cost Control: By evaluating inventory, businesses can monitor costs associated with production, procurement, and storage. This information aids in identifying inefficiencies and optimizing operations.

- Decision Making: Management uses inventory valuation data to make informed decisions regarding pricing, purchasing, and production. It helps assess the profitability of products and the overall health of inventory management.

- Cash Flow Management: Understanding the value of inventory helps businesses manage their cash flow effectively. It aids in determining how much capital is tied up in inventory and informs decisions on stock levels.

- Business Valuation: For mergers, acquisitions, or investments, accurate inventory valuation is crucial for assessing the overall worth of a business.

- Performance Measurement: Inventory valuation assists in analyzing performance metrics such as inventory turnover ratios, which can indicate how efficiently inventory is being managed.

By ensuring accurate inventory valuation, companies can maintain compliance, enhance operational efficiency, and support strategic planning efforts.

What is Required Purpose of Inventory Valuation

The required purposes of inventory valuation are typically aligned with accounting standards and business practices. They include:

- Accurate Financial Reporting: Inventory valuation is essential for presenting an accurate picture of a company’s financial health. It impacts the balance sheet (as current assets) and the income statement (through cost of goods sold), thus affecting net income and equity.

- Compliance with Accounting Standards: Businesses must adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which require proper inventory valuation methods (e.g., FIFO, LIFO, or weighted average) to ensure transparency and comparability.

- Tax Reporting and Compliance: Inventory valuation affects taxable income. Accurate valuation ensures compliance with tax regulations and avoids potential audits or penalties.

- Cost Control and Management: Understanding inventory value helps businesses analyze costs related to production, procurement, and holding inventory. This information is vital for effective budgeting and financial planning.

- Cash Flow Management: Knowing the value of inventory helps in managing cash flow, ensuring that capital is not excessively tied up in unsold goods, which can impact operational liquidity.

- Operational Decision-Making: Accurate inventory valuation supports informed decision-making regarding purchasing, production planning, and inventory management strategies, which can improve efficiency and profitability.

- Performance Measurement: It provides essential data for calculating key performance indicators (KPIs), such as inventory turnover and gross margin, which help assess the efficiency of inventory management practices.

- Risk Management: Regular inventory valuation can help identify potential obsolescence or excess stock issues, allowing companies to mitigate risks associated with inventory management.

By fulfilling these required purposes, businesses can enhance their financial integrity, operational efficiency, and strategic decision-making capabilities.

Who is Required Purpose of Inventory Valuation

The required purposes of inventory valuation are primarily driven by various stakeholders within and outside an organization. Here’s a breakdown of who requires accurate inventory valuation and why:

- Management:

- Decision-Making: Management uses inventory valuation to make informed decisions regarding purchasing, production, and sales strategies.

- Performance Monitoring: Helps in assessing the effectiveness of inventory management practices and overall operational efficiency.

- Accountants and Financial Analysts:

- Financial Reporting: Accurate inventory valuation is essential for preparing financial statements that comply with accounting standards (GAAP or IFRS).

- Cost Analysis: Accountants analyze inventory values to determine cost of goods sold and gross profit margins.

- Investors and Shareholders:

- Financial Health Assessment: Investors require accurate inventory valuations to evaluate a company’s financial health and performance, influencing investment decisions.

- Tax Authorities:

- Tax Compliance: Government tax authorities require accurate inventory valuation to ensure compliance with tax regulations and to calculate taxable income correctly.

- Auditors:

- Audit Verification: External auditors require accurate inventory valuation to verify the integrity of financial statements during audits.

- Supply Chain Managers:

- Inventory Optimization: Supply chain professionals use inventory valuation to optimize stock levels, improve turnover rates, and minimize holding costs.

- Creditors and Lenders:

- Credit Assessment: Banks and financial institutions assess inventory valuation to evaluate the creditworthiness of a business when considering loans or lines of credit.

- Regulatory Bodies:

- Compliance Monitoring: Regulatory agencies may require accurate inventory valuations to ensure businesses comply with industry standards and regulations.

By meeting the requirements of these stakeholders, companies can maintain credibility, improve operational efficiency, and support strategic planning efforts.

When is Required Purpose of Inventory Valuation

The required purposes of inventory valuation come into play at various times throughout the business cycle. Here are key instances when inventory valuation is necessary:

- End of Accounting Period:

- Inventory must be valued at the end of each accounting period (monthly, quarterly, or annually) to prepare accurate financial statements.

- Before Financial Reporting:

- Inventory valuation is required just before the preparation of financial statements to ensure compliance with accounting standards and accurate reporting of assets and income.

- During Audits:

- Valuation is essential when external or internal audits are conducted to verify the accuracy of financial records.

- Tax Filing:

- Businesses must conduct inventory valuation before filing tax returns to determine taxable income and ensure compliance with tax regulations.

- Inventory Assessments:

- Regular assessments (e.g., monthly or quarterly) are required to track inventory levels, costs, and potential obsolescence, aiding in effective inventory management.

- Before Major Business Decisions:

- Inventory valuation is necessary before making significant business decisions, such as mergers, acquisitions, or investments, to assess the financial health of the organization.

- Financial Forecasting and Planning:

- Valuation is required during budgeting and forecasting processes to project future cash flows, expenses, and resource allocation.

- Inventory Replenishment:

- Before reordering or restocking, companies need to value current inventory to determine optimal order quantities and minimize excess stock.

- Product Lifecycle Changes:

- When introducing new products or phasing out old ones, accurate inventory valuation is crucial for determining the financial impact on the business.

By conducting inventory valuation at these key times, businesses can ensure accurate financial reporting, effective inventory management, and informed decision-making.

Where is Required Purpose of Inventory Valuation

The required purposes of inventory valuation are relevant across various locations and contexts within a business environment. Here are the key areas where inventory valuation is essential:

- Accounting and Finance Departments:

- Inventory valuation is primarily performed within the accounting and finance departments, where financial statements are prepared, and compliance with accounting standards is ensured.

- Warehouse and Storage Facilities:

- Valuation is conducted within warehouses or storage facilities to assess the physical stock on hand, track inventory levels, and manage stock movements.

- Production and Operations Areas:

- In manufacturing environments, inventory valuation helps manage raw materials, work-in-progress, and finished goods, aiding in production planning and efficiency.

- Retail Environments:

- Retail businesses need to conduct inventory valuation at store locations to assess stock levels, manage product availability, and optimize sales strategies.

- Supply Chain Management:

- Inventory valuation is essential within supply chain management to coordinate procurement, logistics, and distribution activities effectively.

- Tax Compliance Offices:

- Valuation is required in offices that handle tax compliance to ensure that inventory is accurately reported for tax purposes.

- Auditing Firms:

- External auditing firms require access to inventory valuation data during audits to verify the accuracy of financial records and assess compliance with standards.

- Boardroom and Executive Offices:

- Management teams and executives utilize inventory valuation information during strategic planning and decision-making processes regarding investments, acquisitions, and operational changes.

- Regulatory and Compliance Offices:

- Organizations may have dedicated teams or offices that ensure compliance with industry regulations, which require accurate inventory reporting and valuation.

By performing inventory valuation in these key areas, organizations can maintain accurate financial records, optimize inventory management, and support strategic decision-making processes.

How is Required Purpose of Inventory Valuation

The required purposes of inventory valuation are achieved through specific processes and methodologies. Here’s how inventory valuation is typically carried out:

- Selection of Valuation Method:

- Determine Valuation Method: Choose an appropriate inventory valuation method (e.g., FIFO, LIFO, weighted average cost) based on business needs and compliance with accounting standards.

- Consistency: Apply the selected method consistently over time to ensure comparability in financial reporting.

- Physical Inventory Counts:

- Conduct Physical Counts: Perform regular physical inventory counts to verify the actual quantity of inventory on hand. This can be done annually, semi-annually, or at other intervals.

- Cycle Counting: Implement cycle counting for more frequent assessments without disrupting operations.

- Recording Inventory Transactions:

- Track Purchases and Sales: Maintain accurate records of inventory purchases, sales, and returns to reflect changes in inventory levels and values.

- Use Inventory Management Systems: Employ inventory management software to automate tracking and calculations.

- Cost Allocation:

- Allocate Costs Appropriately: Assign costs to inventory items based on the chosen valuation method, including direct costs (e.g., purchase price, freight) and indirect costs (e.g., overhead).

- Valuation at Reporting Dates:

- Determine Value at Period-End: Calculate the value of inventory at the end of each accounting period, ensuring it reflects current market conditions and replacement costs.

- Adjust for Obsolescence: Evaluate inventory for potential obsolescence or impairment and adjust values accordingly.

- Integration with Financial Statements:

- Impact on Financial Reports: Incorporate the inventory valuation into financial statements, influencing the balance sheet (current assets) and income statement (cost of goods sold).

- Disclosure: Provide necessary disclosures in financial reports regarding the inventory valuation method used and any significant changes.

- Compliance and Audit Preparation:

- Maintain Documentation: Keep thorough documentation of inventory valuation methods, counts, and adjustments for audit trails and compliance with regulations.

- Prepare for Audits: Ensure that inventory valuation processes are well-documented and transparent for internal and external audits.

- Performance Monitoring:

- Analyze Inventory Metrics: Use inventory valuation data to analyze key performance indicators (KPIs) such as inventory turnover, gross profit margins, and days sales of inventory (DSI) to inform management decisions.

By implementing these processes effectively, organizations can fulfill the required purposes of inventory valuation, ensuring accuracy in financial reporting, optimizing inventory management, and supporting strategic decision-making.

Case Study on Purpose of Inventory Valuation

Retail Company

Background

Company: Trendy Fashion Co.

Industry: Retail (Clothing and Accessories)

Location: Urban shopping district

Size: Mid-sized company with multiple retail locations and an online presence

Trendy Fashion Co. specializes in providing trendy clothing and accessories for young adults. As the company has grown, it faces challenges in inventory management, including managing stock levels, reducing holding costs, and optimizing sales.

Purpose of Inventory Valuation

- Accurate Financial Reporting:

- Challenge: Trendy Fashion Co. needed to present accurate financial statements to stakeholders, including investors and banks.

- Solution: By implementing a FIFO (First-In, First-Out) inventory valuation method, the company ensured that the oldest inventory (purchased at lower costs) was sold first, providing a realistic representation of current inventory values in financial statements.

- Cost Control:

- Challenge: Rising costs of goods due to increased supplier prices were impacting profit margins.

- Solution: Regular inventory valuation allowed management to identify excess stock and slow-moving items. By analyzing these metrics, the company implemented markdown strategies for underperforming products, effectively controlling costs and reducing excess inventory.

- Cash Flow Management:

- Challenge: The company struggled with cash flow due to tied-up capital in unsold inventory.

- Solution: Accurate inventory valuation helped Trendy Fashion Co. assess the capital tied up in stock. They adjusted purchasing strategies, opting for smaller, more frequent orders, which improved cash flow and ensured that funds were available for other operational needs.

- Decision Making:

- Challenge: Management needed to make informed decisions regarding product offerings and inventory levels.

- Solution: The insights gained from inventory valuation enabled management to identify top-selling items and trends. This data informed decisions about future purchases, product launches, and promotional activities, leading to a more responsive business strategy.

- Tax Compliance:

- Challenge: The company needed to ensure compliance with tax regulations regarding inventory reporting.

- Solution: By maintaining accurate inventory valuations and records, Trendy Fashion Co. was able to ensure that they reported taxable income correctly, minimizing the risk of audits and potential penalties.

- Performance Measurement:

- Challenge: The company wanted to improve operational efficiency and profitability.

- Solution: Regular inventory valuation facilitated the calculation of key performance indicators (KPIs) such as inventory turnover ratios and gross profit margins. This analysis led to actionable insights that improved overall performance.

Results

After implementing systematic inventory valuation practices, Trendy Fashion Co. observed several positive outcomes:

- Increased Profit Margins: By managing inventory more effectively, the company saw a 15% increase in profit margins within one year.

- Improved Cash Flow: Cash flow improved significantly due to reduced holding costs and optimized purchasing strategies.

- Enhanced Decision-Making: The data-driven approach allowed for more strategic decision-making, leading to a successful launch of new product lines based on customer preferences.

- Stronger Stakeholder Confidence: Accurate financial reporting increased investor confidence, leading to additional funding for expansion.

Conclusion

Trendy Fashion Co. exemplifies how effective inventory valuation serves multiple purposes, including accurate financial reporting, cost control, cash flow management, informed decision-making, tax compliance, and performance measurement. By prioritizing inventory valuation, the company enhanced its operational efficiency and financial stability, positioning itself for future growth.

White paper on Purpose of Inventory Valuation

Executive Summary

Inventory valuation is a critical process for businesses that involves determining the worth of inventory at any given time. It plays a vital role in financial reporting, decision-making, and operational efficiency. This white paper explores the various purposes of inventory valuation, its impact on business operations, and best practices for effective implementation.

Introduction

In today’s competitive business landscape, effective inventory management is essential for maintaining profitability and operational efficiency. Inventory valuation serves as a foundational aspect of inventory management, impacting various areas of a business, from financial reporting to strategic planning.

This white paper outlines the primary purposes of inventory valuation, demonstrating its importance for businesses across industries.

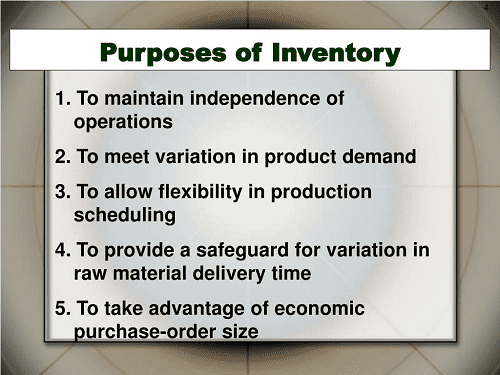

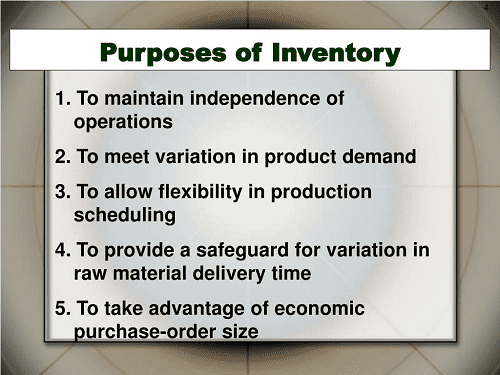

Key Purposes of Inventory Valuation

1. Accurate Financial Reporting

Inventory valuation directly affects a company’s financial statements, particularly the balance sheet and income statement. Accurate valuation ensures that:

- Assets Are Properly Reported: Inventory is a significant current asset; its accurate valuation is crucial for reflecting the company’s true financial position.

- Cost of Goods Sold (COGS) Is Correctly Calculated: Valuation methods such as FIFO, LIFO, and weighted average affect the COGS, impacting net income and tax obligations.

2. Compliance with Accounting Standards

Businesses must adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Inventory valuation helps ensure:

- Consistency and Transparency: Accurate inventory records promote consistency in financial reporting and enhance transparency for stakeholders, including investors and regulatory bodies.

- Audit Readiness: Proper inventory valuation prepares businesses for internal and external audits, reducing the risk of non-compliance.

3. Cost Control and Management

Effective inventory valuation enables businesses to track and manage inventory costs. This is critical for:

- Identifying Excess Stock: Regular valuation helps identify slow-moving or obsolete inventory, allowing businesses to take corrective actions, such as discounting or liquidation.

- Optimizing Procurement: Accurate inventory valuation informs purchasing decisions, helping to avoid overstocking or stockouts.

4. Cash Flow Management

Managing inventory effectively can significantly impact a company’s cash flow. By valuing inventory accurately, businesses can:

- Free Up Working Capital: Reducing excess inventory through effective valuation allows for better allocation of resources and improved liquidity.

- Enhance Financial Planning: Understanding inventory levels and values aids in forecasting cash needs for operations and investments.

5. Informed Decision-Making

Inventory valuation provides essential data for strategic planning and operational decisions, including:

- Product Mix Optimization: Analyzing inventory valuations helps identify high-performing products, guiding decisions on product lines and marketing strategies.

- Operational Efficiency: Data derived from inventory valuation can help streamline operations, improve inventory turnover rates, and reduce carrying costs.

6. Performance Measurement

Regular inventory valuation is essential for assessing business performance through key metrics such as:

- Inventory Turnover Ratio: This ratio helps evaluate how efficiently a company is managing its inventory, indicating operational effectiveness.

- Gross Profit Margin Analysis: Valuation impacts gross profit calculations, allowing businesses to assess profitability and pricing strategies.

7. Risk Management

Inventory valuation aids in identifying and mitigating risks associated with inventory, including:

- Obsolescence Risk: Regular assessment of inventory values can help identify products at risk of becoming obsolete, allowing for proactive measures.

- Market Fluctuations: Understanding the value of inventory in relation to market trends helps businesses adjust strategies in response to changing conditions.

Best Practices for Effective Inventory Valuation

- Select Appropriate Valuation Methods: Choose a valuation method that aligns with the business model and industry standards, ensuring consistency over time.

- Implement Inventory Management Systems: Utilize inventory management software to automate tracking, valuation, and reporting processes, enhancing accuracy and efficiency.

- Conduct Regular Physical Counts: Schedule periodic physical inventory counts to verify quantities on hand and reconcile discrepancies in valuation.

- Monitor Market Conditions: Stay informed about market trends and changes in supplier costs to adjust inventory strategies accordingly.

- Train Staff: Ensure that staff responsible for inventory management are trained in valuation methods, processes, and best practices to maintain accuracy and compliance.

Conclusion

Inventory valuation is a fundamental aspect of effective inventory management that serves multiple purposes, from ensuring accurate financial reporting to supporting strategic decision-making. By prioritizing inventory valuation, businesses can enhance their operational efficiency, financial stability, and overall competitiveness in the market.

Call to Action

Businesses should assess their current inventory valuation practices and consider implementing best practices to optimize inventory management and achieve long-term success.

This white paper serves as a guide for understanding the importance of inventory valuation and the strategic advantages it can provide. For further information or assistance in optimizing inventory management practices, please contact [Your Company/Organization Name].

Industrial Application of Purpose of Inventory Valuation

Inventory valuation is a critical component in various industrial sectors, influencing financial performance, operational efficiency, and strategic decision-making. Below are specific applications across different industries:

1. Manufacturing

- Raw Material Management: In manufacturing, accurate inventory valuation of raw materials is essential for calculating production costs and optimizing purchasing strategies. By employing methods like FIFO or LIFO, manufacturers can better manage costs, especially in volatile markets.

- Work-in-Progress (WIP) Valuation: Understanding the value of WIP inventory helps manufacturers assess production efficiency, identify bottlenecks, and optimize labor and resources.

- Finished Goods Valuation: Accurate valuation of finished goods aids in pricing strategies, ensuring profitability while remaining competitive in the market.

2. Retail

- Seasonal Stock Management: Retailers often deal with seasonal inventory. Accurate valuation helps in planning promotions, managing markdowns, and optimizing stock levels based on seasonal demand.

- Sales Forecasting: Retail inventory valuation provides insights into inventory turnover rates, helping businesses forecast sales more accurately and manage replenishment processes.

- Shrinkage Control: Regular inventory valuation helps identify discrepancies due to theft, damage, or errors, allowing retailers to implement measures to reduce shrinkage.

3. Pharmaceuticals

- Regulatory Compliance: The pharmaceutical industry requires strict adherence to regulations regarding inventory management. Accurate inventory valuation ensures compliance with guidelines set by regulatory bodies, affecting financial reporting and operational practices.

- Expiry Management: Pharmaceuticals often have expiration dates. Valuation practices must account for potential losses from expired products, impacting financial forecasts and inventory management strategies.

- Supply Chain Efficiency: Accurate inventory valuation enables pharmaceutical companies to manage their supply chains effectively, ensuring timely availability of products while minimizing excess stock.

4. Construction

- Material Cost Estimation: In the construction industry, accurate valuation of building materials is crucial for budgeting and cost control. It helps project managers assess project costs and make informed procurement decisions.

- Equipment Valuation: Construction companies often have significant investments in machinery and equipment. Accurate valuation of these assets is essential for financial reporting and investment decisions.

- Project Management: Understanding the value of inventory related to specific projects helps in assessing project profitability and resource allocation.

5. Food and Beverage

- Perishable Goods Management: In the food industry, inventory valuation is vital for managing perishable goods. Businesses must account for spoilage and obsolescence, impacting financial performance.

- Cost Control: Accurate inventory valuation helps food and beverage companies manage costs effectively, ensuring that pricing strategies reflect actual costs and market conditions.

- Regulatory Compliance: Food safety regulations require accurate tracking and valuation of inventory to ensure compliance and maintain product quality.

6. Automotive

- Parts Inventory Management: Automotive manufacturers and retailers rely on accurate inventory valuation of spare parts to ensure timely repairs and customer satisfaction.

- Supplier Relationships: Valuation data informs negotiations with suppliers, helping automotive companies manage costs and ensure favorable terms.

- Forecasting Demand: Accurate valuation of inventory aids in forecasting demand for vehicles and parts, allowing for better production planning and inventory management.

Conclusion

The industrial applications of inventory valuation demonstrate its critical role across various sectors. By understanding and implementing effective inventory valuation practices, companies can enhance operational efficiency, improve financial performance, and make informed strategic decisions. This is especially important in today’s dynamic business environment, where accurate inventory management is essential for sustaining competitiveness and profitability.

- Readers’ index to Wikipedia

- Statistics

- Administration

- FAQs Purpose

- Who writes Wikipedia?

- Organization

- Censorship

- In brief

- General disclaimer

- Student help

- Navigation

- Searching

- Viewing media Help

- Mobile access

- Parental advice

- Other languages

- Researching with Wikipedia Citing Wikipedia

- Copyright

- Main introduction

- List of tutorials and introductions

- The answer

- Dos and don’ts

- Learning the ropes

- Common mistakes

- Newcomer primer

- Simplified ruleset

- The “Missing Manual”

- Your first article Wizard

- Young Wikipedians

- The Wikipedia Adventure

- Accounts Why create an account?

- Logging in

- Email confirmation

- Editing Toolbar

- Conflict

- VisualEditor User guide

- Five pillars

- Manual of Style Simplified

- Etiquette Expectations

- Oversight

- Principles

- Ignore all rules The rules are principles

- Core content policies

- Policies and guidelines

- Vandalism

- Appealing blocks

- What Wikipedia is not

- Help menu

- Help desk

- Reference Desk

- Category

- Requests for help Disputes resolution requests

- IRC live chat Tutorial

- Contact us

- Departments

- Meetups

- WikiProjects Overview

- FAQ

- Village pump policy

- technical

- proposals

- idea lab

- wikimedia

- misc

- Newsletters: Signpost

- Library Newsletter

- GLAM Newsletter

- Informational: Community portal

- Dashboard Noticeboards

- Maintenance Task Center

- Essays

- Category

- Abbreviations

- Contents

- Edit summaries

- Essays

- Glossary

- Index

- Shortcuts

- Tips

- Wiki markup Cheatsheet

- Columns

- HTML

- Lists

- Magic words For beginners

- Sections

- Sounds

- Special Characters

- Tables

- Templates Documentation

- Index

- Substitution

- Transclusion

- Image and video markup Tutorial

- Linking

- Accretion/dilution analysis

- Adjusted present value

- Associate company

- Business valuation

- Conglomerate discount

- Cost of capital Weighted average

- Discounted cash flow

- Economic value added

- Enterprise value

- Fairness opinion

- Financial modeling

- Free cash flow Free cash flow to equity

- Market value added

- Minority interest

- Mismarking

- Modigliani–Miller theorem

- Net present value

- Pure play

- Real options

- Residual income

- Stock valuation

- Sum-of-the-parts analysis

- Tax shield

- Terminal value

- Valuation using multiples